eBay 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

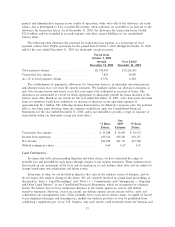

reporting unit. The fair values of the reporting units are estimated using a combination of the income, or

discounted cash Öows, approach and the market approach, which utilizes comparable companies' data. If

the carrying amount of the reporting unit exceeds its fair value, goodwill is considered impaired and a

second step is performed to measure the amount of impairment loss, if any. Our annual impairment test

was carried out as of August 31, 2003 and there were no events or circumstances from that date through

December 31, 2003 that would impact this assessment.

The increased amortization expense in 2003 primarily reÖects the full-year amortization resulting from

our acquisition of PayPal on October 3, 2002. Amortization of acquired intangible assets decreased during

2002, primarily from the elimination of goodwill amortization as part of our adoption of SFAS No. 142,

""Goodwill and Other Intangible Assets'' on January 1, 2002. We expect amortization of acquired

intangible assets will increase in 2004 as a result of the incremental acquired intangible assets associated

with our purchase of additional ownership interests in EachNet and Internet Auction Co. during 2003.

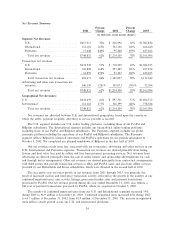

Non-Operating Items

Interest and Other Income, Net

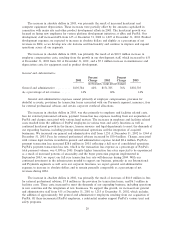

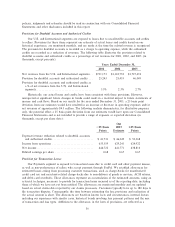

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Interest and other income, netÏÏÏÏÏÏÏÏÏÏÏ $41,613 18% $49,209 (23)% $37,803

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏ 6% 4% 2%

Interest and other income, net consists of interest earned on cash, cash equivalents and investments as

well as foreign exchange transaction gains and losses and other miscellaneous non-operating transactions.

Our interest and other income, net decreased in absolute dollars and as a percentage of net revenues

during 2003, primarily as a result of one-time gains recognized in 2002 from the sale of certain

subsidiaries, real estate properties and an equity investment that totaled $20.3 million. This decrease was

oÅset, in part, by increased investment income on a larger aggregate balance of cash, cash equivalents and

investments even though the weighted-average interest rate of our portfolio declined to 1.6% in 2003 from

2.8% in 2002. We expect that interest and other income, net, will increase in absolute dollars during 2004,

as our cash, cash equivalents, and investments balances continue to grow.

Our interest and other income, net increased during 2002 primarily as a result of one-time gains from

the sale of certain subsidiaries, real estate properties and an equity investment that totaled $20.3 million.

These gains were oÅset by a decrease in interest and investment income of $4.1 million resulting from

lower average interest rates, despite an increase in our cash, cash equivalents and investments balances in

2002 and from decreased realized gains on the sale of investments, and a decrease in foreign exchange

gains of $3.5 million. Our weighted-average interest rate decreased to approximately 2.8% in 2002 from

3.6% in 2001.

Interest Expense

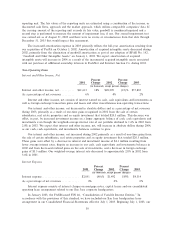

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Interest expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,851 (48)% $1,492 189% $4,314

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏ 0% 0% 0%

Interest expense consists of interest charges on mortgage notes, capital leases and our consolidated

operating lease arrangement related to our San Jose corporate headquarters.

In January 2003, the FASB issued FIN 46, ""Consolidation of Variable Interest Entities.'' In

accordance with the provisions of this standard, we have included our San Jose headquarters lease

arrangement in our Consolidated Financial Statements eÅective July 1, 2003. Beginning July 1, 2003, our

30