eBay 2003 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

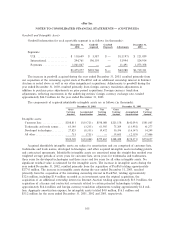

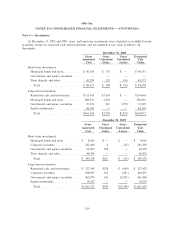

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

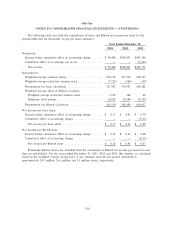

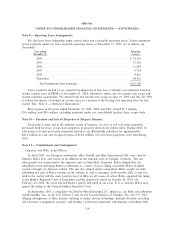

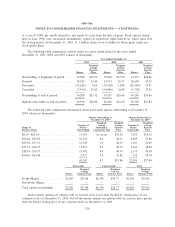

The following table summarizes the fair value and gross unrealized losses of our long-term

investments, aggregated by type of investment instrument and length of time that individual securities have

been in a continuous unrealized loss position, at December 31, 2003 (in thousands):

Gross

Unrealized

Fair Value Losses

Restricted cash and investmentsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 63,331 $ (440)

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 431,689 (534)

Government and agency securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 340,863 (2,067)

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $835,883 $(3,041)

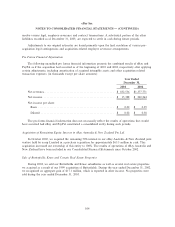

At December 31, 2003, our gross unrealized losses on investments were all in loss positions for less

than 12 months.

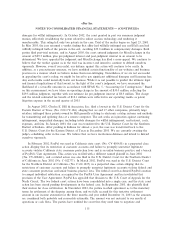

Our investment portfolio consists of both corporate and government securities that have a maximum

maturity of three years. The longer the duration of these securities, the more susceptible they are to

changes in market interest rates and bond yields. As yields increase, those securities purchased with a

lower yield-at-cost show a mark-to-market unrealized loss. All unrealized losses are due to changes in

interest rates and bond yields. We expect to realize the full value of all these investments upon maturity or

sale. The losses on these securities have an average duration of approximately 3.8 months.

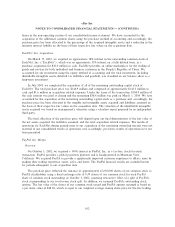

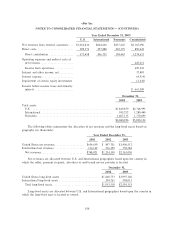

The estimated fair value of short and long-term investments classiÑed by date of contractual maturity

at December 31, 2003 are as follows (in thousands):

December 31,

2003

Due within one year or lessÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 340,576

Due after one year through two years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 286,581

Due after two years through three years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 633,338

Due after three years through four years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì

Restricted cash and investments expiring in less than Ñve years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 127,432

Equity investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14,252

$1,402,179

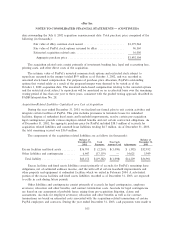

During 2001, 2002 and 2003, we recorded impairment charges totaling $16.2 million, $3.8 million and

$1.2 million, respectively, as a result of the deterioration of the Ñnancial condition of certain of our private

and public equity investees that were considered to be other than temporary.

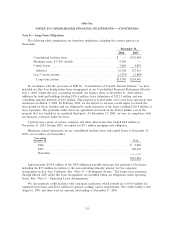

Note 6 Ì Derivative Instruments:

We entered into two interest rate swaps on June 19 and July 20, 2000, with notional amounts totaling

$95 million to reduce the impact of changes in interest rates on a portion of the Öoating rate operating

lease for our primary oÇce facilities. The interest rate swaps allow us to receive Öoating rate receipts based

on the London Interbank OÅered Rate, or LIBOR, in exchange for making Ñxed rate payments of

approximately 7% of the notional amount, which eÅectively changes our interest rate exposure on our

operating lease from a Öoating rate to a Ñxed rate on $95 million of the total $126.4 million notional

amount of our corporate headquarters facility lease commitment. The balance of $31.4 million remains at

a Öoating rate of interest based on the spread over 3-month LIBOR. The fair value of the interest rate

110