eBay 2003 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

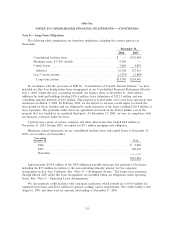

damages for willful infringement). In October 2002, the court granted in part our summary judgment

motion, eÅectively invalidating the patent related to online auction technology and rendering it

unenforceable. This ruling left only two patents in the case. Trial of the matter began on April 23, 2003.

In May 2003, the jury returned a verdict Ñnding that eBay had willfully infringed one and Half.com had

willfully infringed both of the patents in the suit, awarding $35.0 million in compensatory damages. Both

parties Ñled post-trial motions, and in August 2003, the court entered judgment for MercExchange in the

amount of $29.5 million, plus pre-judgment interest and post-judgment interest in an amount to be

determined. We have appealed the judgment and MercExchange has Ñled a cross-appeal. We continue to

believe that the verdict against us in the trial was incorrect and intend to continue to defend ourselves

vigorously. However, even if successful, our defense against this action will continue to be costly. In

addition, as a precautionary measure, we have modiÑed certain functionality of our websites and business

practices in a manner which we believe makes them non-infringing. Nonetheless, if we are not successful

in appealing the court's ruling, we might be forced to pay signiÑcant additional damages and licensing fees.

Any such results could materially harm our business. While it is not possible to predict the ultimate legal

and Ñnancial implications of this lawsuit, in the light of the court's judgment, we have reassessed the

likelihood of a favorable outcome in accordance with SFAS No. 5, ""Accounting for Contingencies.'' Based

on this reassessment, we have taken an operating charge in the amount of $30.0 million, reÖecting the

$29.5 million judgment, together with our estimate for pre-judgment interest of $0.5 million. The charge

and the related estimated tax beneÑt of $12.1 million were reÖected in our operating results as patent

litigation expense in the second quarter of 2003.

In August 2002, Charles E. Hill & Associates, Inc. Ñled a lawsuit in the U.S. District Court for the

Eastern District of Texas (No. 2:02-CV-186) alleging that we and 17 other companies, primarily large

retailers, infringed three patents owned by Hill generally relating to electronic catalog systems and methods

for transmitting and updating data at a remote computer. The suit seeks an injunction against continuing

infringement, unspeciÑed damages, including treble damages for willful infringement, and interest, costs,

expenses, and fees. In January 2003, the case was transferred to the U.S. District Court for the Southern

District of Indiana. After pending in Indiana for almost a year, the case was transferred back to the

U.S. District Court for the Eastern District of Texas in December 2003. We are currently awaiting the

judge's scheduling order in the case. We believe that we have meritorious defenses and intend to defend

ourselves vigorously.

In February 2002, PayPal was sued in California state court (No. CV-805433) in a purported class

action alleging that its restriction of customer accounts and failure to promptly unrestrict legitimate

accounts violates California state consumer protection laws and is an unfair business practice and a breach

of PayPal's User Agreement. This action was re-Ñled with a diÅerent named plaintiÅ in June 2002

(No. CV-808441), and a related action was also Ñled in the U.S. District Court for the Northern District

of California in June 2002 (No. C-022777). In March 2002, PayPal was sued in the U.S. District Court

for the Northern District of California (No. C-02-1227) in a purported class action alleging that its

restrictions of customer accounts and failure to promptly unrestrict legitimate accounts violates federal and

state consumer protection and unfair business practice laws. The federal court has denied PayPal's motion

to compel individual arbitration as required by the PayPal User Agreement and has invalidated that

provision of the User Agreement. PayPal has appealed that decision to the U.S. Court of Appeals for the

Ninth Circuit. The two federal court actions have been consolidated into a single case, and the state court

action has been stayed pending developments in the federal case. In September 2003, the plaintiÅs Ñled

their motion for class certiÑcation. In November 2003, the parties reached agreement as to the monetary

terms for settlement of the disputes among them, and we fully accrued for this tentative settlement

amount in our income statement for the three months and year ended December 31, 2003 as the amounts

are considered both probable and reasonably estimable. The amount was not material to our results of

operations or cash Öows. The parties have notiÑed the court that they need time to negotiate and

115