eBay 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

We also entered into two interest rate swaps with two separate Ñnancial institutions to reduce our

interest rate exposure on our San Jose corporate headquarters lease payments. If either of these Ñnancial

institutions should fail to deliver under these contracts, we may be subject to variable interest rate

payments.

During the years ended and as of December 31, 2002 and 2003, no customers accounted for more

than 10% of net revenues or net accounts receivable.

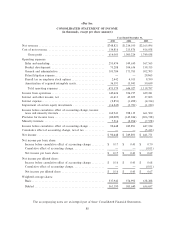

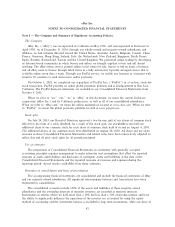

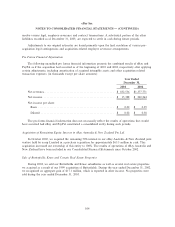

Allowances for transaction losses

Our Payments segment is exposed to transaction losses due to fraud, as well as non-performance of

customers and others. We establish allowances for estimated losses arising from processing customer

transactions, such as charge-backs for unauthorized credit card use and merchant related charge-backs due

to non-delivery of goods or services, Automated Clearing House, or ACH, returns, and debit card

overdrafts. These allowances represent an accumulation of the estimated amounts, using an actuarial

technique, necessary to provide for transaction losses incurred as of the reporting date, including those to

which we have not yet been notiÑed. The allowances are monitored monthly and are updated based on

actual claims data reported by our claims processors. Customers typically have up to 180 days to Ñle

transaction disputes. Consequently, the time between estimating the loss provisions and realization of the

actual amount is short. The allowances are based on known facts and circumstances, internal factors

including our experience with similar cases, historical trends involving loss payment patterns and the mix

of transaction and loss types. Additions to the allowance, in the form of provisions, are reÖected as a

general and administrative expense in our consolidated statement of income, while write-oÅs to the

allowance are made when a loss is determined to have occurred. Recoveries, when collected, are recorded

as an increase to the allowance for transaction losses. At December 31, 2003 and 2002, the allowance for

transaction losses totaled $12.0 million and $10.1 million, respectively, and was included in accrued

expenses and other current liabilities in our consolidated balance sheet.

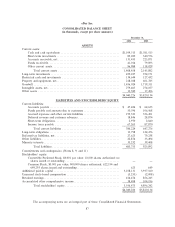

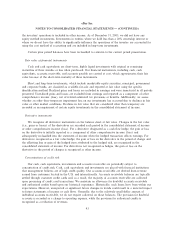

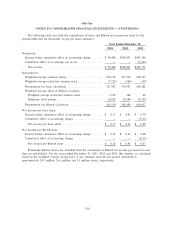

Funds receivable and funds payable

Funds receivable and payable relate to our Payments segment and arise due to the time taken to clear

transactions through external payment networks. When customers fund their account using their bank

account or credit card, or withdraw money to their bank account or through a debit card transaction, there

is a clearing period before the cash is received or sent by PayPal, usually two or three days. Hence, these

funds are treated as a receivable or payable until the cash is settled.

Foreign currency

Substantially all of our foreign subsidiaries use the local currency of their respective countries as their

functional currency. Assets and liabilities are translated at exchange rates prevailing at the balance sheet

dates. Revenues, costs and expenses are translated into United States dollars at average exchange rates for

the period. Gains and losses resulting from translation are accumulated as a component of other

comprehensive income (loss).

Realized gains and losses from foreign currency transactions are recognized as other income and are

insigniÑcant for all periods presented.

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation and

amortization are computed using the straight-line method over the estimated useful lives of the assets,

generally, one to three years for computer equipment and software, up to thirty years for buildings and

94