eBay 2003 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

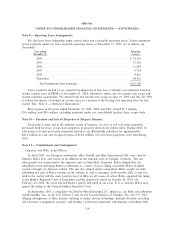

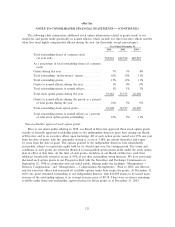

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

and complexity. In particular, we expect to face additional patent infringement claims involving services we

provide, including various aspects of our Payments business. We have in the past been forced to litigate

such claims. We may also become more vulnerable to intellectual property claims as laws such as the

Digital Millennium Copyright Act are interpreted by the courts and as we expand into jurisdictions where

the underlying laws with respect to the potential liability of online intermediaries like ourselves is less

favorable. We expect that we will increasingly be subject to copyright and trademark infringement claims

as the geographical reach of our services expands. These claims, whether meritorious or not, could be time

consuming, result in costly litigation, cause service upgrade delays, require expensive changes in our

methods of doing business, or could require us to enter into costly royalty or licensing agreements.

From time to time, we are involved in other disputes that arise in the ordinary course of business. The

number and signiÑcance of these disputes is increasing as our business expands and our company grows

larger. Any claims against us, whether meritorious or not, could be time consuming, result in costly

litigation, require signiÑcant amounts of management time, and result in the diversion of signiÑcant

operational resources.

While we currently believe that the ultimate resolution of these unresolved matters will not have a

material adverse impact on our Ñnancial position, cash Öow or results of operations, the litigation and other

claims noted above are subject to inherent uncertainties and our view of these matters may change in the

future. Were an unfavorable Ñnal outcome to occur, there exists the possibility of a material adverse

impact on our Ñnancial position and results of operations for the period in which the eÅect becomes

reasonably estimable. We are unable to determine what potential losses we may incur if these matters

were to have an unfavorable outcome.

IndemniÑcation Provisions

During the ordinary course of business, in certain limited circumstances, we have included

indemniÑcation provisions within certain of our contracts. Pursuant to these agreements, we indemnify,

hold harmless, and agree to reimburse the indemniÑed party for losses suÅered or incurred by the

indemniÑed party, generally parties with which we have commercial relations, in connection with certain

intellectual property infringement claims by any third party with respect to our services. To date, we have

not incurred any costs in connection with such indemniÑcation clauses.

Note 12 Ì Related Party Transactions:

We have entered into indemniÑcation agreements with each of our directors, executive oÇcers and

certain other oÇcers. These agreements require us to indemnify such individuals, to the fullest extent

permitted by Delaware law, for certain liabilities to which they may become subject as a result of their

aÇliation with us.

Commercial agreements

A member of our Board of Directors and the Audit and Compensation Committees of our Board of

Directors, is a general partner of certain venture capital funds that beneÑcially hold in the aggregate a

greater than 10% equity interest in several public and private companies. We engaged in the following

transactions with such companies:

In December 1999, we entered into an Internet marketing agreement with a privately held company

that facilitates buying decisions for consumers. Under this agreement, we paid fees approximating $503,000

in 2001, and none in 2002 or 2003 for the promotion of eBay.

In April 2000, we entered into an advertising and promotions agreement with a privately held

company that provides a marketplace for live advice. Under this agreement, we recognized revenues of

117