eBay 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income statement reÖects the reclassiÑcation of lease payments on our San Jose headquarters from

operating expense to interest expense. The increase in interest expense in 2003, is primarily the result of

this new accounting standard. We expect our interest expense will increase in absolute dollars, due to the

inclusion of a full year of the interest payments on our San Jose lease, and will remain generally

comparable as a percentage of net revenue during 2004.

The decrease in interest expense during 2002, compared to the prior year, was primarily the result of

a reduction in the outstanding mortgage note balances in connection with the sale of certain underlying

properties.

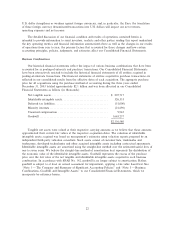

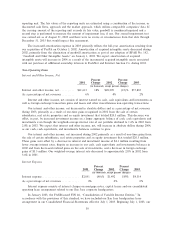

Impairment of Certain Equity Investments

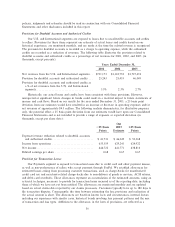

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Impairment of certain equity investments ÏÏÏ $16,245 (77)% $3,781 (67)% $1,230

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏ 2% 0% 0%

During 2003, 2002 and 2001, we recorded impairment charges totaling $1.2 million, $3.8 million and

$16.2 million, respectively, as a result of the deterioration of the Ñnancial condition of certain of our

private and public equity investees. We identiÑed these impairment losses as part of our normal process of

assessing the quality of our investment portfolio. They reÖect declines in fair value and other market

conditions that we believe are other than temporary. We expect that the fair value of our equity

investments will Öuctuate from time to time and future impairment assessments may result in additional

charges to our operating results.

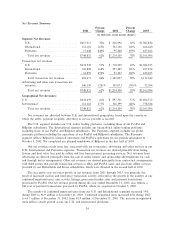

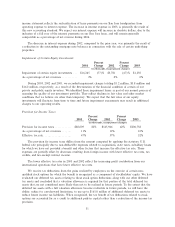

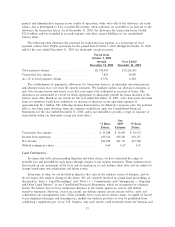

Provision for Income Taxes

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏ $80,009 82% $145,946 42% $206,738

As a percentage of net revenues ÏÏÏÏÏÏÏ 11% 12% 10%

EÅective tax rateÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 47% 37% 32%

The provision for income taxes diÅers from the amount computed by applying the statutory U.S.

federal rate principally due to non-deductible expenses related to acquisitions, state taxes, subsidiary losses

for which we have not provided a beneÑt and other factors that increase the eÅective tax rate. These

expenses are partially oÅset by decreases resulting from foreign income with lower eÅective tax rates, tax

credits, and tax-exempt interest income.

The lower eÅective tax rates in 2003 and 2002 reÖect the increasing proÑt contribution from our

international operations that have lower eÅective tax rates.

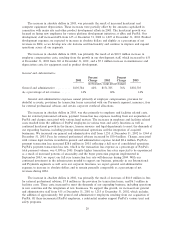

We receive tax deductions from the gains realized by employees on the exercise of certain non-

qualiÑed stock options for which the beneÑt is recognized as a component of stockholders' equity. We have

evaluated our deferred tax assets relating to these stock option deductions along with our other deferred

tax assets and concluded that a valuation allowance is required for that portion of the total deferred tax

assets that are not considered more likely than not to be realized in future periods. To the extent that the

deferred tax assets with a full valuation allowance become realizable in future periods, we will have the

ability, subject to carryforward limitations, to use up to $165.8 million of additional deferred tax assets to

reduce future income tax liabilities. When recognized, the tax beneÑt of tax deductions related to stock

options are accounted for as a credit to additional paid-in capital rather than a reduction of the income tax

provision.

31