eBay 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

could result in a material adverse impact on the Ñnancial position, results of operations or cash Öows of all

or any of our three segments.

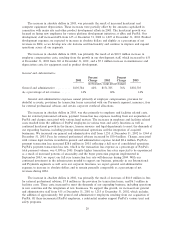

Accounting for Income Taxes

We are required to recognize a provision for income taxes based upon the taxable income and

temporary diÅerences for each of the tax jurisdictions in which we operate. This process requires a

calculation of taxes payable under currently enacted tax laws around the world and an analysis of

temporary diÅerences between the book and tax bases of our assets and liabilities, including various

accruals, allowances, depreciation and amortization. The tax eÅect of these temporary diÅerences and the

estimated tax beneÑt from our tax net operating losses are reported as deferred tax assets and liabilities in

our consolidated balance sheet. We also assess the likelihood that our net deferred tax assets will be

realized from future taxable income. To the extent we believe that it is more likely than not that some

portion, or all of, the deferred tax asset will not be realized, we establish a valuation allowance. To the

extent we establish a valuation allowance or change the allowance in a period, we reÖect the change with a

corresponding increase or decrease in our tax provision in our income statement. Where the change in the

valuation allowance relates to the deduction for employee stock option exercises, the change is reÖected as

a credit to additional paid-in capital. As employee stock option exercises are highly dependent upon our

stock price, it is extremely diÇcult to predict the amount of deductions that will be generated from future

option exercises and, therefore, for us to ascertain the amount of deferred tax assets related to employee

stock option exercises that may be realized in future periods. The deferred tax asset, net of a valuation

allowance of $165.8 million, totaled $52.0 million at December 31, 2003 and was oÅset by deferred tax

liabilities of $107.1 million resulting in a net deferred tax liability of $55.1 million. In addition, due to our

signiÑcant anticipated international expansion, we have not provided for U.S. federal income and foreign

withholding taxes on non-U.S. subsidiaries' undistributed earnings as of December 31, 2003, because such

earnings are intended to be reinvested indeÑnitely. In the event that our future international expansion

plans change and such amounts are not reinvested indeÑnitely, we would be subject to U.S. income taxes

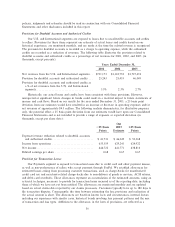

partially oÅset by foreign tax credits. The following table illustrates the provision for income taxes as a

percentage of income before income taxes for 2001, 2002, and 2003 (in thousands, except percents):

Year Ended December 31,

2001 2002 2003

Income before income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $170,457 $395,837 $653,922

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 80,009 145,946 206,738

As a % of income before income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 47% 37% 32%

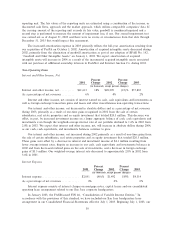

Historically, these provisions have adequately provided for our actual income tax liabilities. However,

unexpected or signiÑcant future changes in trends could result in a material impact to future statements of

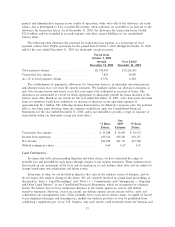

income and cash Öows. Based on our results for the year ended December 31, 2003, a one-percentage

point change in our provision for income taxes as a percentage of income before taxes would have resulted

in an increase or decrease in expense of approximately $6.5 million. The following analysis demonstrates,

for illustrative purposes only, the potential eÅect such a one-percentage point deviation change would have

upon our Ñnancial statements and is not intended to provide a range of exposure or expected deviation (in

thousands, except per share data):

Our

2003

¿1% Estimate °1%

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $200,199 $206,738 $213,277

Income before income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 653,922 653,922 653,922

Net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 448,310 441,771 435,232

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.68 0.67 0.66

38