eBay 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

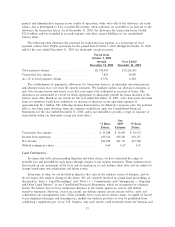

international expansion. In 2003, purchases of property and equipment included the $125.1 million

purchase of additional oÇce space in San Jose, California. Purchases of property and equipment in 2003

also included amounts for improvements to various facilities in the U.S. and around the world as well as

computer equipment and software to support our site operations, customer support and international

expansion. We expect capital expenditures for the purchase of property and equipment to approximate

$250 million during 2004, without taking into account any acquisitions or other costs associated with the

potential purchase of additional facilities. This amount for 2004 consists primarily of hardware and

software for our platform architecture, site operations and corporate information systems. Cash expended

for acquisitions, net of cash acquired, totaled $111.7 million in 2001, $59.4 million in 2002 and

$216.4 million in 2003. In 2001, we expended cash to acquire a controlling interest in Internet Auction,

located in South Korea. Our cash acquisitions in 2002 included acquiring the remaining ownership interest

in our Billpoint subsidiary and a 38% interest in EachNet, located in China. We completed our acquisition

of PayPal during 2002 through the exchange of our common stock, and we did not include cash payments

in the purchase price. Our cash acquisitions in 2003 included acquiring the remaining ownership interest in

EachNet and an additional ownership interest in Internet Auction Co.

The net cash Öows provided by Ñnancing activities in 2001, 2002 and 2003 were due primarily to

proceeds from stock option exercises. Proceeds from stock option exercises totaled $123.7 million in 2001,

$252.2 million in 2002 and $700.8 million in 2003. Our future cash Öows from stock options are diÇcult to

project as such amounts are a function of both our stock price and the decisions by employees to exercise

stock options. In general, we expect proceeds from stock option exercises to increase during periods in

which our stock price has increased.

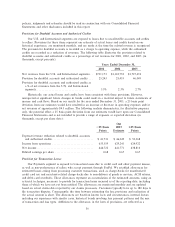

Commitments and Contingencies

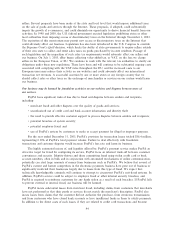

The contractual obligations presented in the table below represent our estimates of future payments

under Ñxed contractual obligations and commitments. Changes in our business needs, cancellation

provisions, changing interest rates, and other factors may result in actual payments diÅering from the

estimates. We cannot provide certainty regarding the timing and amounts of payments. We have presented

below a summary of the most signiÑcant assumptions used in our determination of amounts presented in

the tables, in order to assist in the review of this information within the context of our consolidated

Ñnancial position, results of operations, and cash Öows. The following table summarizes our Ñxed

contractual obligations and commitments (in thousands):

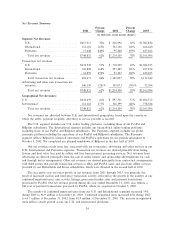

Other

Year Ending Capital Operating Purchase

December 31, Leases Leases Obligations Total

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 2,840 $ 22,765 $265,237 $290,842

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 128,376 17,556 162,912 308,844

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 11,693 54,580 66,273

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 9,724 7,601 17,325

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 9,661 749 10,410

ThereafterÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 44,361 Ì 44,361

$131,216 $115,760 $491,079 $738,055

Capital lease amounts include leases obligations associated with computer and other oÇce equipment.

The amounts presented are consistent with contractual terms and are not expected to diÅer signiÑcantly,

unless we decide to purchase the individual assets prior to the end of the respective lease terms. The

purchase obligation amount in 2005 also includes the assumed purchase of the corporate headquarters in

San Jose, California, in March 2005, when the lease is scheduled to expire. See ""Note 17 Ì Subsequent

Events'' in the notes to the Consolidated Financial Statements.

34