eBay 2003 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

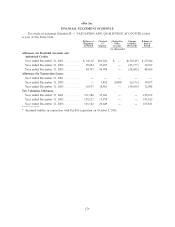

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

of employee stock options of $391.1 million and the remainder relates to losses at certain subsidiaries. We

receive tax deductions from the gains realized by employees on the exercise of certain non-qualiÑed stock

options for which the beneÑt is recognized as a component of stockholders' equity. We have evaluated the

deferred tax assets relating to these stock option deductions along with our other deferred tax assets and

concluded that a valuation allowance is required for that portion of the total deferred tax assets that are

not considered more likely than not to be realized in future periods. To the extent that the deferred tax

assets with a valuation allowance become realizable in future periods, we will have the ability, subject to

carryforward limitations, to beneÑt from these amounts. When recognized, the tax beneÑt of tax

deductions related to stock options are accounted for as a credit to additional paid-in capital rather than a

reduction of the income tax provision.

We have not provided for U.S. federal income and foreign withholding taxes on non-U.S. subsidiaries'

undistributed earnings as of December 31, 2003, because such earnings are intended to be reinvested in

the operations and potential acquisitions of our International segment indeÑnitely. Upon distribution of

those earnings in the form of dividends of otherwise, we would be subject to U.S. income taxes (subject to

an adjustment for foreign tax credits).

Note 17 Ì Subsequent Events:

On January 26, 2004, we entered into an agreement with mobile.de to acquire all of its outstanding

shares for 121 million Euros (approximately $153 million at the January 26, 2004 exchange rate), subject

to certain closing adjustments, plus acquisition costs. mobile.de is a classiÑeds website for vehicles in

Germany. The acquisition, which is subject to regulatory approval in Germany by the Federal Cartel

OÇce, is expected to close in the second quarter of 2004. The acquisition will be accounted for under the

purchase method of accounting.

In February 2004, we elected not to exercise certain rights to extend the lease period for our San Jose

corporate headquarters. The lease on these facilities will end on March 1, 2005, and we are obligated to

make payments to the lessor of $126.4 million at lease expiration.

124