eBay 2003 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

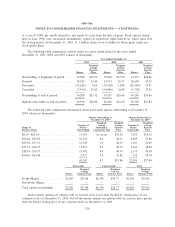

Note 8 Ì Long-Term Obligations:

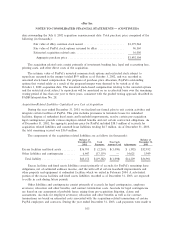

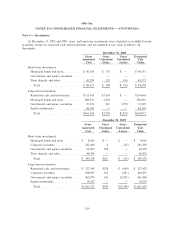

The following table summarizes our long-term obligations, including the current portion (in

thousands):

December 31,

2002 2003

Consolidated facilities lease ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $122,498

Mortgage notes, 8.175% variable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,300 Ì

Capital leases ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,468 4,818

SubtotalÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 16,768 127,316

Less: Current portionÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,970) (2,840)

Long-term portion ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $13,798 $124,476

In accordance with the provisions of FIN 46, ""Consolidation of Variable Interest Entities,'' we have

included our San Jose headquarters lease arrangement in our Consolidated Financial Statements eÅective

July 1, 2003. Under this new accounting standard, our balance sheet at December 31, 2003 reÖects

additions for land and buildings totaling $126.4 million, lease obligations of $122.5 million and non-

controlling minority interests of $3.9 million. This property is leased under a Ñve-year lease agreement that

terminates on March 1, 2005. In February 2004, we elected not to exercise certain rights to extend the

lease period for these facilities and are obligated to make payments to the lessor totalling $126.4 million at

lease expiration. The payments under this lease agreement are based on the $126.4 million cost of the

property that was funded by an unrelated third-party. At December 31, 2003, we were in compliance with

our Ñnancial covenants under the lease.

Capital leases consist of various computer and other oÇce leases that totaled $4.8 million at

December 31, 2003. During 2003, we repaid our $9.3 million mortgage note obligation.

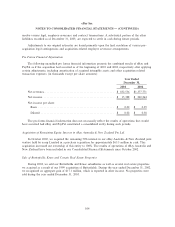

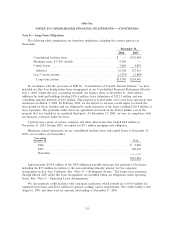

Minimum annual repayments on our consolidated facilities lease and capital leases at December 31,

2003, are as follows (in thousands):

Year ending

December 31, Total

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 2,840

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 128,376

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì

$131,216

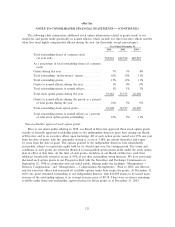

Approximately $126.4 million of the 2005 obligation payable represents the payment to the lessor,

including the $3.9 million in relation to the non-controlling minority interest, for the corporate

headquarters in San Jose, California. See ""Note 17 Ì Subsequent Events.'' The future lease payments

through March 2005 under this lease arrangement are included within our obligations under operating

leases. See ""Note 9 Ì Operating Lease Arrangements.''

We also maintain credit facilities with a Ñnancial institution, which provide up to $14.4 million for

equipment purchases and $23.2 million for general working capital requirements. The credit facility is due

August 6, 2005 and there were no amounts outstanding at December 31, 2003.

113