eBay 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

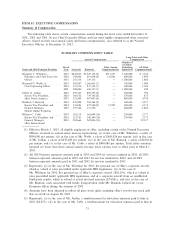

2001 ($90,243); and (iii) in the case of each of the Named Executive OÇcers, insurance premiums

we paid with respect to group life insurance for their beneÑt and matching contributions under our

401(k) Plan (subject to the maximum of $1,500 per annum).

(6) Represents for 2003, $1,159,132 paid under eBay's Management Incentive Plan and an additional

$70,000 bonus granted by the Compensation Committee in 2004 and, represents for 2002, $329,698

paid under eBay's Management Incentive Plan and an additional $90,000 bonus granted by the

Compensation Committee in 2003.

(7) Represents for 2003, $620,501 paid under eBay's Management Incentive Plan and $646,100 paid

under Mr. Webb's special retention plan, represents for 2002, $387,254 paid under eBay's

Management Incentive Plan and $449,900 paid under Mr. Webb's special retention plan and

represents for 2001, $290,927 paid under eBay's Management Incentive Plan and $355,200 under

Mr. Webb's special retention plan. See ""Item 13: Certain Relationships and Related Transactions.''

(8) Represents for 2003, $361,505 for 2003 paid under eBay's Management Incentive Plan, $497,288

under Mr. Jordan's special retention plans, represents for 2002, $202,212 paid under eBay's

Management Incentive Plan, $522,550 under Mr. Jordan's special retention plans and $15,000

pursuant to our discretionary reward program, and represents for 2001, $153,041 paid under eBay's

Management Incentive Plan and $314,000 under Mr. Jordan's special retention plan. See ""Item 13:

Certain Relationships and Related Transactions.''

(9) Represents for 2003, $346,264 paid under eBay's Management Incentive Plan, $250,000 under

Mr. Bannick's special retention plan and Represents for 2002, $207,540 paid under eBay's

Management Incentive Plan, $250,000 under Mr. Bannick's special retention plan and $15,000

pursuant to our discretionary reward program. See ""Item 13: Certain Relationships and Related

Transactions.''

(10) Represents for 2003, $298,899 paid under eBay's Management Incentive Plan, $70,000 under

Mr. Cobb's special retention plan, represents for 2002, $170,390 paid under eBay's Management

Incentive Plan and $70,000 under Mr. Cobb's special retention plan and represents for 2001,

$132,026 paid under eBay's Management Incentive Plan and $70,000 under Mr. Cobb's special

retention plan. See ""Item 13: Certain Relationships and Related Transactions.''

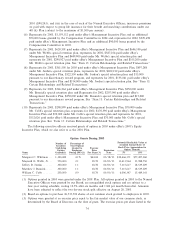

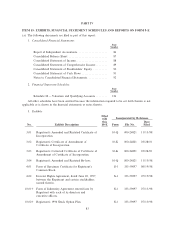

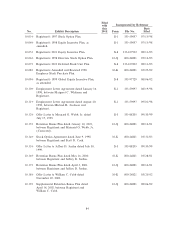

The following executive oÇcers received grants of options in 2003 under eBay's 2001's Equity

Incentive Plan, which we also refer to as the 2001 Plan.

Option Grants During 2003

Potential Realizable Value at

Number of Percentage of Assumed Annual Rates of

Securities Total Options Stock Price Appreciation for

Underlying Granted to Exercise Option Term(4)

Options Employees Price Expiration

Name Granted(1) During 2003(2) Per Share(3) Date 5% 10%

Margaret C. Whitman ÏÏÏ 1,100,000 4.1% $44.04 03/18/13 $30,466,171 $77,207,260

Maynard G. Webb, Jr. ÏÏ 550,000 2.1 38.78 03/03/13 13,411,964 33,988,550

JeÅrey D. Jordan ÏÏÏÏÏÏÏ 300,000 1.1 38.78 03/03/13 7,315,617 18,539,209

Matthew J. BannickÏÏÏÏÏ 300,000 1.1 38.78 03/03/13 7,315,617 18,539,209

William C. Cobb ÏÏÏÏÏÏÏ 250,000 0.9 38.78 03/03/13 6,096,347 15,449,341

(1) Options granted in 2003 were granted under the 2001 Plan. All options granted in 2003 to the Named

Executive OÇcers were granted by our Board, are nonqualiÑed stock options and are subject to a

four-year vesting schedule, vesting 12.5% after six months and 1/48 per month thereafter. Amounts

have been adjusted to reÖect the two-for-one stock split eÅective on August 28, 2003.

(2) Based on options to purchase 26,533,518 shares of our common stock granted to employees in 2003.

(3) Options were granted at an exercise price equal to the fair market value of our common stock, as

determined by the Board of Directors on the date of grant. The exercise prices per share listed in the

74