eBay 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

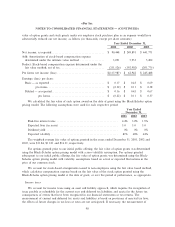

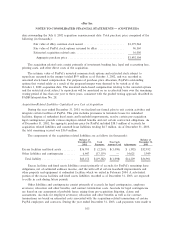

days surrounding the July 8, 2002 acquisition announcement date. Total purchase price comprised of the

following (in thousands):

Fair value of eBay common stock issued ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,379,944

Fair value of PayPal stock options assumed by eBay ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 96,560

Estimated acquisition related costs ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 16,000

Aggregate purchase price ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,492,504

The acquisition related costs consist primarily of investment banking fees, legal and accounting fees,

printing costs, and other direct costs of the acquisition.

The intrinsic value of PayPal's unvested common stock options and restricted stock subject to

repurchase assumed in the merger totaled $9.9 million as of October 3, 2002, and was recorded as

unearned stock-based compensation. For purposes of purchase price allocation, PayPal's outstanding

options that vested solely as a result of the proposed merger were deemed to be vested as of the

October 3, 2002 acquisition date. The unearned stock-based compensation relating to the unvested options

and the restricted stock subject to repurchase will be amortized on an accelerated basis over the remaining

vesting period of less than one year to three years, consistent with the graded vesting approach described in

FASB Interpretation No. 28.

Acquisition-Related Liabilities Capitalized as a Cost of Acquisition

During the year ended December 31, 2003, we Ñnalized our formal plan to exit certain activities and

integrate certain facilities of PayPal. This plan includes provisions to terminate leases for redundant

facilities, dispose of redundant Ñxed assets and leasehold improvements, resolve certain pre-acquisition

legal contingencies, provide various employee-related beneÑts and exit certain contractual obligations. As

of December 31, 2002, the aggregate purchase price for PayPal included $38.5 million of accruals for

acquisition related liabilities and assumed lease liabilities totaling $4.7 million. As of December 31, 2003,

the total remaining accrual was $36.9 million.

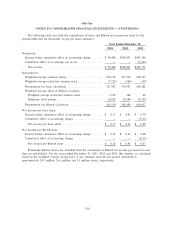

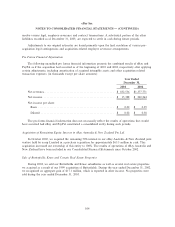

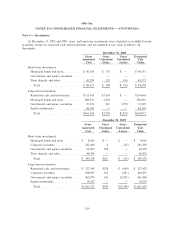

The components of the acquisition related liabilities are as follows (in thousands):

Balance at Balance at

December 31, Cash Non-Cash December 31,

2002 Payments Amount Used Adjustments 2003

Excess facilities and Ñxed assets ÏÏÏÏÏÏÏÏÏ $36,705 $ (2,263) $(1,098) $ (392) $32,952

Other liabilities and contingencies ÏÏÏÏÏÏÏÏ 6,447 (17,119) Ì 14,621 3,949

Total liability ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $43,152 $(19,382) $(1,098) $14,229 $36,901

Excess facilities and Ñxed assets liabilities consist primarily of accruals for PayPal's remaining lease

obligations, net of estimated sublease income, and the write-oÅ of certain leasehold improvements and

other property and equipment at redundant facilities which we exited in February 2004. A substantial

portion of the excess facilities and Ñxed assets liabilities recorded as of December 31, 2003, are expected

to settle in cash during future periods.

Other liabilities and contingencies consist primarily of accruals for legal contingencies, employee

severance, relocation and other beneÑts, and contract termination costs. Accruals for legal contingencies

are based on our assessment of probable losses arising from pre-acquisition litigation, claims and

assessments. Accruals for employee severance, relocation and other beneÑts as well as for contract

terminations are based on estimated costs associated with the acquisition-related terminations of certain

PayPal employees and contracts. During the year ended December 31, 2003, cash payments were made to

103