eBay 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

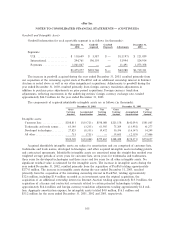

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

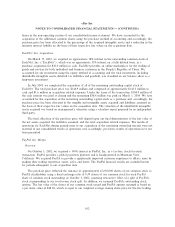

Custodial accounts

We deposit all U.S.-based customer funds not transferred to PayPal's Money Market Fund into

Federal Deposit Insurance Corporation, or FDIC, insured bank accounts. FDIC insurance is available to

U.S. based PayPal customers if we (1) place pooled customer funds in bank accounts denominated

""PayPal as Agent for the BeneÑt of its Customers'' or similar caption, (2) maintain records suÇcient to

identify the claim of each customer in the FDIC-insured account, (3) comply with applicable FDIC

recordkeeping requirements, and (4) truly operate as an agent of our customers. We receive a custodial

credit from our service provider in the form of a reduction in transaction processing fees based upon

balances held with each institution. This credit is recognized as a reduction in processing costs.

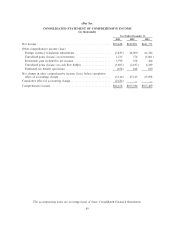

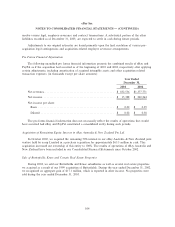

Comprehensive income

Comprehensive income includes all changes in equity (net assets) during a period from non-owner

sources. The change in accumulated other comprehensive income for all periods presented resulted from

foreign currency translation gains and losses, unrealized and realized gains and losses on investments, and

unrealized gains and losses on cash Öow hedges.

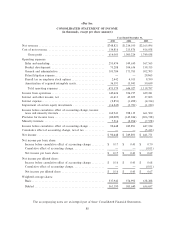

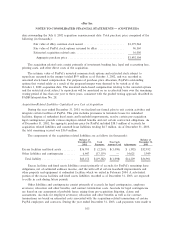

Revenue recognition

Our net revenues result from fees associated with our transaction, advertising and other non-

transaction services in our U.S., International and Payments segments. Transaction revenue is derived

primarily from listing, feature and Ñnal value fees paid by sellers and fees from payment processing

services. Revenue from advertising is derived principally from the sale of online banner and sponsorship

advertisements for cash and through barter arrangements. Other non-transaction net revenue is primarily

composed of our end-to-end services net revenue that is derived principally from contractual arrangements

with third parties that provide transaction services to eBay users. Other non-transaction net revenue was

also derived from our oÉine services from a variety of sources including seller commissions, buyer

premiums, bidder registration fees and auction-related services including appraisal and authentication,

primarily related to our ButterÑelds and Kruse subsidiaries.

Listing and feature fee revenues are recognized ratably over the estimated period of the auction while

revenues related to Ñnal value fees are recognized at the time that the transaction is successfully

concluded. A transaction is considered successfully concluded when at least one buyer has bid above the

seller's speciÑed minimum price or reserve price, whichever is higher, at the end of the transaction term.

We earn transaction fees, allocated to our Payments segment, from processing transactions for certain

customers. Revenue resulting from a payment processing transaction is recognized once the transaction is

complete. Provisions for doubtful accounts, authorized credits and transaction losses are made at the time

of revenue recognition based upon our historical experience. The provision for doubtful accounts is

recorded as a charge to operating expense, while the provisions for authorized credits and transaction losses

are recognized as reductions of net revenues.

Our advertising revenue is derived principally from the sale of online banner and sponsorship

advertisements for cash and through barter arrangements. To date, the duration of our banner and

sponsorship advertising contracts has ranged from one week to Ñve years, but is generally one week to one

year. Advertising revenues on both banner and sponsorship contracts are recognized as ""impressions'' (i.e.,

the number of times that an advertisement appears in pages viewed by users of our websites) are delivered

or ratably over the term of the agreement where such agreements provide for minimum monthly or

quarterly advertising commitments or where such commitments are Ñxed throughout the term. Barter

transactions are valued on amounts realized in similar cash transactions occurring within six months prior

to the date of the barter transaction. To the extent that signiÑcant delivery obligations remain at the end of

a period or collection of the resulting account receivable is not considered probable, revenues are deferred

96