eBay 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

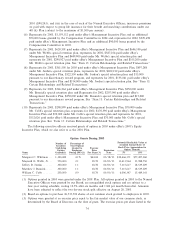

ITEM 7A: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

The primary objective of our investment activities is to preserve principal while at the same time

maximizing yields without signiÑcantly increasing risk. To achieve this objective, we maintain our portfolio

of cash equivalents, short-term and long-term investments in a variety of securities, including government

and corporate obligations and money market funds. These securities are generally classiÑed as available for

sale and consequently are recorded on the balance sheet at fair value with unrealized gains or losses

reported as a separate component of accumulated other comprehensive income (loss), net of estimated

tax.

Investments in both Ñxed-rate and Öoating-rate interest-earning instruments carry varying degrees of

interest rate risk. The fair market value of our Ñxed-rate securities may be adversely impacted due to a

rise in interest rates. In general, securities with longer maturities are subject to greater interest-rate risk

than those with shorter maturities. While Öoating rate securities generally are subject to less interest-rate

risk than Ñxed-rate securities, Öoating-rate securities may produce less income than expected if interest

rates decrease. Due in part to these factors, our investment income may fall short of expectations or we

may suÅer losses in principal if securities are sold that have declined in market value due to changes in

interest rates. As of December 31, 2003, our Ñxed-income investments earned a pretax yield of

approximately 1.69%, with a weighted average maturity of 7.5 months. If interest rates were to

instantaneously increase (decrease) by 100 basis points, the fair market value of the total investment

portfolio could decrease (increase) by approximately $17.5 million.

We entered into two interest rate swaps on June 19 and July 20, 2000, with notional amounts totaling

$95 million to reduce the impact of changes in interest rates on a portion of the Öoating rate operating

lease for our primary oÇce facilities. The interest rate swaps allow us to receive Öoating rate receipts based

on the London Interbank OÅered Rate, or LIBOR, in exchange for making Ñxed rate payments which

eÅectively changes our interest rate exposure on our operating lease from a Öoating rate to a Ñxed rate on

$95 million of the total $126.4 million notional amount of our corporate headquarters facility lease

commitment. The balance of $31.4 million remains at a Öoating rate of interest based on the spread over

3-month LIBOR. If the 3-month LIBOR rates were to increase (decrease) by 100 basis points, then our

payments would increase (decrease) by $78,000 per quarter.

Equity Price Risk

We are exposed to equity price risk on the marketable portion of equity investments we hold, typically

as the result of strategic investments in third parties that are subject to considerable market risk due to

their volatility. We typically do not attempt to reduce or eliminate our market exposure in these equity

investments. As of December 31, 2003, we did not have any unrealized gains or losses associated with our

equity investments. In accordance with our policy to assess whether an impairment loss on our investments

has occurred due to declines in fair value and other market conditions, we determined that declines in fair

value of certain of our marketable and non-marketable equity investments were other than temporary.

Accordingly, we recorded impairment charges totaling $16.2 million, $3.8 million and $1.2 million during

the years ended December 31, 2001, 2002 and 2003, respectively, relating to the other-than-temporary

impairment in the fair value of equity investments. At December 31, 2003, the total fair value of our

equity investments was $14.3 million, including $1.1 million in marketable investments. At December 31,

2002, the total fair value of our equity investments was $44.2 million, including $3.4 million in marketable

investments.

Foreign Currency Risk

International net revenues result from transactions by our foreign operations and are typically

denominated in the local currency of each country. These operations also incur most of their expenses in

the local currency. Accordingly, our foreign operations use the local currency, which is primarily the Euro

as their functional currency. Our international operations are subject to risks typical of international

66