eBay 2003 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

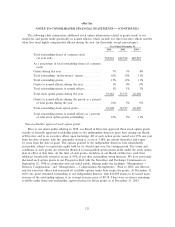

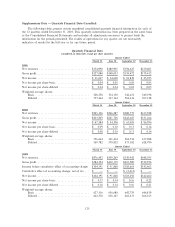

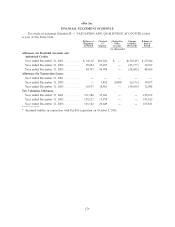

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

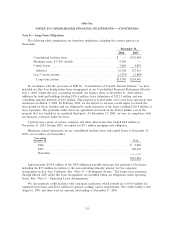

approximately $1.0 million in 2001, $200,000 in 2002 and none in 2003. In 1999, we invested $2.0 million

in capital stock of such company and received a warrant to purchase additional shares, which if exercised

would bring our total ownership to less than 5% of its capital stock.

In July 2000, we entered into an advertising and promotions agreement, which we subsequently

amended in December 1999 and April 2000, with a privately held company that provides a real estate

solution to home buyers and sellers. Under the terms of this agreement, we recognized revenues of

approximately $441,000 in 2001, and none in 2002 or 2003. The member of our Board of Directors

mentioned above is also a member of such company's Board of Directors. In 2000, we invested

$3.0 million in capital stock of such company and received a warrant to purchase additional shares, which

if exercised would bring our total ownership to less than 5% of its capital stock.

In February 2001, our wholly owned subsidiary Half.com, entered into a content licensing and

inventory sales agreement with a company that provides order management and fulÑllment solutions.

Under this agreement, such company agreed to list its inventory on Half.com's website and to allow

Half.com to use such company's catalog data to supplement Half.com's existing catalog data. Half.com

paid such company approximately $100,000 in 2001, $25,000 in 2002 and none in 2003 under this

agreement.

Separately, a member of our Board of Directors is a director and Chairman of the Executive

Committee of the Board of Directors of a company with whom PayPal, in September 2000, prior to eBay's

acquisition of PayPal, entered into a strategic marketing agreement. The agreement was terminated in

December 2002, and PayPal paid the company an early termination fee of $1,348,000 in January 2003 in

accordance with the terms of the agreement. In addition, in July 2003, the company purchased an entity

with which eBay had a pre-existing data licensing agreement. Under the terms of eBay's agreement with

the purchased entity, eBay recognized $156,251 of revenue in 2003, and expects to recognize revenue of up

to $26,000 per month in 2004.

All contracts with related parties are at rates and terms that we believe are comparable with those

entered into with independent third parties.

Notes receivable from eBay executive oÇcers

At December 31, 2002 and 2003, we held notes receivable from certain executive oÇcers totaling

$3.5 million and $630,000, respectively. During 2003, all but one of such outstanding notes were pre-paid

in full. The remaining outstanding note is a non-interest-bearing note issued in connection with the

relocation of one executive oÇcer to San Jose, California. The outstanding note is collateralized by a Deed

of Trust, which we hold. The outstanding principal is due and payable in November 2005.

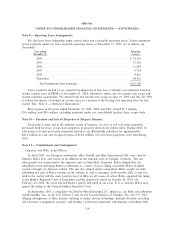

Note 13 Ì Preferred Stock:

We are authorized, subject to limitations prescribed by Delaware law: to issue Preferred Stock in one

or more series; to establish the number of shares included within each series; to Ñx the rights, preferences

and privileges of the shares of each wholly unissued series and any related qualiÑcations, limitations or

restrictions; and to increase or decrease the number of shares of any series (but not below the number of

shares of a series then outstanding) without any further vote or action by the stockholders. At

December 31, 2002 and 2003, there were 10 million shares of Preferred Stock authorized for issuance, and

no shares issued or outstanding.

Note 14 Ì Common Stock:

Our CertiÑcate of Incorporation, as amended, authorizes us to issue 900 million shares of common

stock. A portion of the shares outstanding are subject to repurchase over a four-year period from the

118