eBay 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

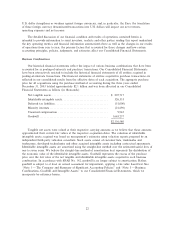

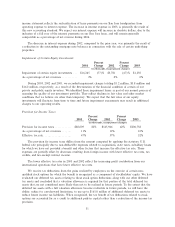

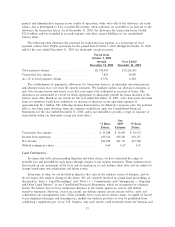

Minority Interests

Percent Percent

2001 Change 2002 Change 2003

(in thousands, except percent changes)

Minority interests ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $7,514 (131)% $(2,296) (230)% $(7,578)

As a percentage of net revenue ÏÏÏÏÏÏÏÏÏÏÏ 1% 0% 0%

Minority interests in consolidated companies represents the minority investors' percentage share of

income or losses from subsidiaries in which we hold a majority ownership interest and consolidate the

subsidiaries' results in our Ñnancial statements. Third parties held minority interests in various of our

subsidiaries during 2003, 2002 and 2001.

The change in minority interests in 2003 is due primarily to the minority interests' portion of the net

income generated by Internet Auction. We expect that minority interests will continue to Öuctuate in

future periods. If Internet Auction continues to be proÑtable, the minority interests adjustment on the

consolidated statement of income will continue to decrease our net income by the minority investor's share

of Internet Auction's net income.

The change in minority interests in 2002 primarily resulted from Internet Auction generating net

income for the Ñrst time in 2002 along with our January 2002 acquisition of the remaining 35% minority

interest in Billpoint.

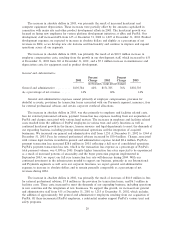

Cumulative EÅect of Change in Accounting Principle

In accordance with the provisions of FIN 46, ""Consolidation of Variable Interest Entities,'' we have

included our San Jose headquarters lease arrangement in our Consolidated Financial Statements eÅective

July 1, 2003. Under this new accounting standard, our balance sheet at December 31, 2003, reÖects

additions for land and buildings totaling $126.4 million, lease obligations of $122.5 million and non-

controlling minority interests of $3.9 million. Our income statement for the year ended December 31,

2003, reÖects the reclassiÑcation of lease payments on our San Jose headquarters from operating expense

to interest expense, beginning with the quarters following our adoption of FIN 46 on July 1, 2003, a

$5.4 million after-tax charge for cumulative depreciation for periods from lease inception through June 30,

2003, and incremental depreciation expense of approximately $400,000, net of tax, per quarter for the third

and fourth quarters of 2003. We have adopted the provisions of FIN 46 prospectively from July 1, 2003,

and as a result, have not restated prior periods. The cumulative eÅect of the change in accounting

principle arising from the adoption of FIN 46 has been reÖected in net income in 2003.

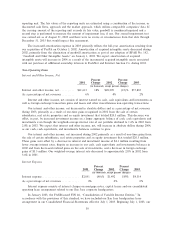

Impact of Foreign Currency Translation

During 2003, our international net revenues, based upon the country in which the seller, payment

recipient, advertiser or other service provider is located, accounted for 35% of our consolidated net

revenues, as compared to 26% of our net revenues in 2002 and 15% of our net revenues in 2001. The

growth in our international operations has increased our exposure to foreign currency Öuctuations. Net

revenues and related expenses generated from international locations are denominated in the functional

currencies of the local countries, and include Euros, British Pounds, Korean Won, Canadian Dollars and

Australian Dollars. The results of operations and certain of our intercompany balances associated with our

international locations are exposed to foreign exchange rate Öuctuations. The income statements of our

international operations are translated into U.S. dollars at the average exchange rates in each applicable

period. To the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign

currency denominated transactions results in increased net revenues, operating expenses and net income.

Similarly, our net revenues, operating expenses and net income will decrease when the U.S. dollar

strengthens against foreign currencies.

A signiÑcant portion of our international net revenues, operating expenses and net income are

denominated in Euros. During 2003, the U.S. dollar weakened against the Euro. The weighted-average

32