eBay 2003 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2003 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

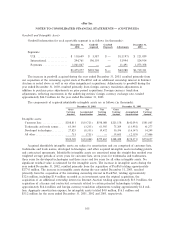

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

losses in the non-operating section of our consolidated income statement. We have accounted for the

acquisition of the additional common shares using the purchase method of accounting and accordingly, the

purchase price has been allocated to the percentage of the acquired intangible assets and a reduction in the

minority interest liability on the basis of their respective fair values on the acquisition date.

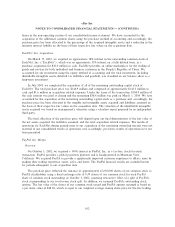

EachNet, Inc. Acquisition

On March 17, 2002, we acquired an approximate 38% interest in the outstanding common stock of

EachNet, Inc. (""EachNet''), which was an approximate 33% interest on a fully diluted basis, in a

purchase acquisition for $30.0 million in cash. EachNet provides an online marketplace for the trading of

goods and services for both individual and business customers in the People's Republic of China. We

accounted for our investment using the equity method of accounting and the total investment, including

identiÑable intangible assets, deferred tax liabilities and goodwill, was classiÑed on our balance sheet as a

long-term investment.

In July 2003, we completed the acquisition of all of the remaining outstanding capital stock of

EachNet. The total purchase price was $144.9 million and comprised of approximately $143.3 million in

cash and $1.6 million in acquisition related expenses. Under the terms of the transaction, $104.9 million of

the cash amount was paid at closing and the remaining $38.4 million was paid on March 1, 2004. We have

accounted for the acquisition of the remaining outstanding capital stock as a purchase and, accordingly, the

purchase price has been allocated to the tangible and intangible assets acquired and liabilities assumed on

the basis of their respective fair values on the acquisition date. The valuation of the identiÑable intangible

assets acquired was based on management's estimates using a valuation report prepared by an independent

third-party.

The Ñnal allocation of the purchase price will depend upon our Ñnal determination of the fair value of

the net assets acquired, the liabilities assumed, and the total acquisition related expenses. The results of

operations for EachNet during periods prior to our acquisition of the remaining ownership interest were not

material to our consolidated results of operations and, accordingly, pro forma results of operations have not

been presented.

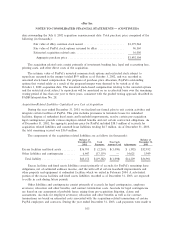

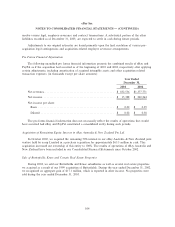

PayPal, Inc. Merger

Overview

On October 3, 2002, we acquired a 100% interest in PayPal, Inc. in a tax-free, stock-for-stock

transaction. PayPal provides a global payments platform and is headquartered in Mountain View,

California. We acquired PayPal to provide a signiÑcantly improved customer experience to eBay's users by

making their trading experience easier, safer, and faster. The PayPal Ñnancial results are included herein

for periods subsequent to our acquisition date.

The purchase price reÖected the issuance of approximately 47,650,000 shares of our common stock to

PayPal stockholders using a Ñxed exchange ratio of 0.39 shares of our common stock for each PayPal

share of common stock outstanding on October 3, 2002, assuming retroactive eÅect of a split of PayPal's

stock corresponding to our two-for-one stock split. In addition, we assumed PayPal's outstanding stock

options. The fair value of the shares of our common stock issued and PayPal options assumed is based on

a per share value of $28.96, which is equal to our weighted average closing share price for the Ñve trading

102