eBay 2002 Annual Report Download - page 90

Download and view the complete annual report

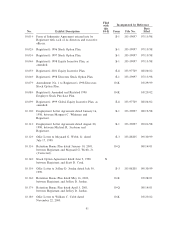

Please find page 90 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Payment amounts under Mr. Webb's bonus plan are $355,200 for 2001, $449,900 for 2002, $646,100 for

2003 and $1,154,000 for 2004, and may be used to pay principal and interest payments owing to us under

the terms of his loan. In August 2001 and August 2002, in accordance with the terms of his loan,

Mr. Webb paid down $355,200 and $449,900, respectively, of principal and accrued interest on the loan.

The maximum indebtedness of Mr. Webb to us during 2002 was $2,077,211. In January 2003, Mr. Webb

prepaid in full the principal and accrued interest on his loan in the amount of approximately $1,670,800.

In May 2000, Mr. Jordan, our Senior Vice President and General Manager, U.S. Business, entered

into two four-year term loans with us at an interest rate of 6.40% per annum, with principal and accrued

interest payable on each loan in equal installments on each anniversary. The principal amounts on the

loans were $1,000,000 and $900,000, respectively, with the loan amounts secured by Mr. Jordan's principal

place of residence. In May 2000, we entered into a special retention bonus plan with Mr. Jordan under

which Mr. Jordan received bonus payments in May of 2001 and 2002 and remains eligible to receive

bonus payments in May 2003 and 2004 if he is then employed by us. Payment amounts under this bonus

plan with Mr. Jordan are $314,000 for 2001, $298,000 for 2002, $282,000 for 2003, and $266,000 for 2004,

and may be used to pay principal and interest payments Mr. Jordan will then owe to us under the loans

described in this paragraph. In July 2000, Mr. Jordan repaid in full the principal and accrued interest on

the $900,000 term loan. In addition, in April 2001, Mr. Jordan entered into a four-year term loan with us

at an interest rate of 4.94% per annum, with principal and accrued interest payable in equal installments

on each anniversary of this loan. The principal amount on this loan was $750,000, with the loan amount

secured by Mr. Jordan's principal place of residence. In April 2001, we entered into a second special

retention bonus plan with Mr. Jordan under which Mr. Jordan received bonus payments in April of 2002

and remains eligible to receive bonus payments in April 2003, 2004 and 2005 if he is then employed by us.

Payment amounts under this bonus plan with Mr. Jordan are $224,550 for 2002, $215,288 for 2003,

$206,025 for 2004, and $196,763 for 2005, and may be used to pay principal and interest payments

Mr. Jordan will then owe to us under the loans described in this paragraph. In May 2001 and May 2002,

Mr. Jordan paid down $314,000 and $298,000, respectively, of principal and accrued interest on his May

2000 loan. In April 2002, Mr. Jordan paid down $224,550 of principal and accrued interest on his April

2001 loan. The maximum indebtedness of Mr. Jordan to us during 2002 was $1,579,050.

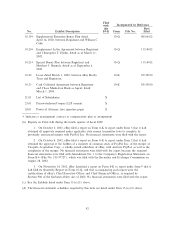

In March 2001, in connection with his relocation to San Jose as a result of his joining eBay in late

2000, Mr. Cobb, our Senior Vice President and General Manager, eBay International, entered into a four-

year, non-interest bearing term loan with us in the amount of $840,000. The loan to Mr. Cobb is secured

by his principal place of residence. Principal payments of $70,000 are due on the Ñrst, second and third

anniversaries of the date Mr. Cobb joined eBay (November 27, 2000), with a balloon payment of the

remaining principal due on November 27, 2004. In November 2000, we entered into a special retention

bonus plan with Mr. Cobb under which Mr. Cobb received a $70,000 bonus payment in November of

2001 and 2002 and remains eligible to receive bonus payments in November 2003 and 2004 if he is then

employed by us. In April 2002, we entered into a second special retention bonus plan with Mr. Cobb

under which Mr. Cobb will receive a $280,000 bonus payment on November 27, 2004 if he is then

employed by us. Mr. Cobb may use these bonus payments to pay principal payments due under his loan.

In November 2001 and 2002, Mr. Cobb paid down $70,000 and $70,000, respectively, of principal on his

loan. The maximum indebtedness of Mr. Cobb to us during 2002 was $770,000.

In September 2002, we entered into a special retention bonus plan with Mr. Bannick. Under the

terms of this bonus plan, Mr. Bannick received a $250,000 bonus payment after the closing of our

acquisition of PayPal in October 2002 and upon his acceptance of the new position as our Senior Vice

President and General Manager, Global Online Payments. Mr. Bannick remains eligible to receive

performance-based bonus payments related primarily to the integration and performance of our PayPal

subsidiary of up to $250,000 on each of the nine-month, 18-month, and 24-month anniversaries of the

October 2002 closing of the PayPal acquisition.

Mr. Omidyar, our Founder and the Chairman of our Board of Directors, and Mr. Skoll, a beneÑcial

owner of more than 5% of our common stock, from time to time make their personal aircraft available to

88