eBay 2002 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

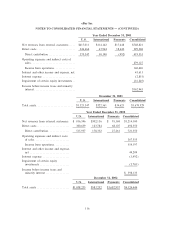

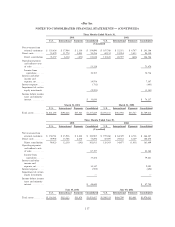

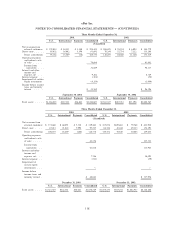

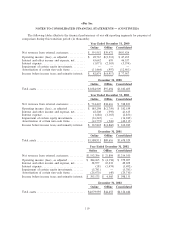

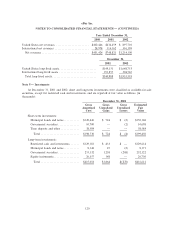

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

and sell new and previously owned goods at discounted prices. In connection with the merger, we issued,

or reserved for issuance, a total of approximately 5,484,000 shares of eBay common stock to Half.com's

existing shareholders, option holders and warrant holders as consideration for all shares of capital stock,

options and warrants of Half.com held immediately prior to consummation of the merger. The merger was

accounted for as a pooling of interests.

Internet Auction Co., Ltd.

On February 15, 2001, we acquired an approximately 51% majority interest in Internet Auction Co.,

Ltd., a South Korean company in a purchase acquisition for $120.8 million in cash and incurred

$1.1 million of direct acquisition costs. Internet Auction introduced online trading in South Korea when it

launched in April 1998. Shares of Internet Auction are listed on the KOSDAQ. The transaction was

accounted for using the purchase method of accounting and accordingly, the results of operations of

Internet Auction have been included in our Consolidated Financial Statements since February 15, 2001.

iBazar S.A.

On May 18, 2001, we acquired a 100% interest in iBazar S.A. iBazar is a French-based corporation

that introduced online trading in France and at the time of the acquisition had websites in Belgium, Brazil,

France, Italy, the Netherlands, Portugal, Spain and Sweden. As consideration for the acquisition, we

issued shares in a Belgian subsidiary exchangeable for 2,045,054 shares of eBay common stock valued at

$120.4 million, paid $2.3 million in cash to certain shareholders and incurred acquisition-related costs of

approximately $2.9 million. The shares issued in the acquisition were valued on May 18, 2001, the Ñrst

date on which the number of eBay's shares and the amount of other consideration became Ñxed, using the

average closing price of eBay shares for the Ñve days prior to and including the closing date of May 18,

2001. The transaction was accounted for using the purchase method of accounting and accordingly, the

results of operations of iBazar have been included in our Consolidated Financial Statements since May 18,

2001.

We have established plans to exit certain activities of iBazar and to involuntarily terminate certain

iBazar employees. In accordance with this exit plan included in our purchase accounting, approximately

$2.0 million has been accrued for the estimated costs associated with severance, contract terminations and

Ñnancial advisory and legal fees and has been included in net tangible assets. As of December 31, 2002,

we have utilized all of the $2.0 million liability. In addition, we are in the process of resolving various

income tax related contingencies that could result in an increase in goodwill to the extent that an

unfavorable outcome is reached.

In September 2001, we entered into a strategic business relationship with MercadoLibre, a leading

online auction site serving Latin America. In exchange for our equity interest in iBazar Com Ltda, a

Brazilian subsidiary of iBazar, we received a 19.5% ownership interest in MercadoLibre. We accounted for

this investment in MercadoLibre using the cost method, and no gain or loss was recognized on the

exchange.

NeoCom Technology Co., Ltd. Acquisition

In April 2002, we acquired a 100% interest in NeoCom Technology Co., Ltd. in a purchase

acquisition for $11.1 million cash and incurred direct acquisition costs of $198,000. NeoCom provides an

online Chinese language marketplace for the trading of goods and services in Taiwan. The results of

operations of NeoCom have been included in our Consolidated Financial Statements since April 2002.

110