eBay 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

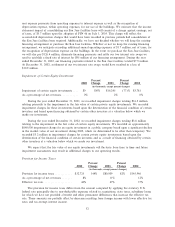

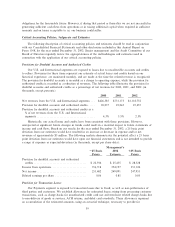

and is not intended to provide a range of exposure or expected deviation (in thousands, except per share

data):

Management's

2002

¿1% Estimate °1%

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $142,105 $145,946 $150,022

Income before income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 395,837 395,837 395,837

Net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 253,732 249,891 245,815

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.87 0.85 0.84

Third-party Advertising Revenues

Our third-party advertising revenues are derived principally from the sale of online banner and

sponsorship advertisements for cash and through barter arrangements. To date, the duration of our banner

and sponsorship advertising contracts has ranged from one week to three years, but is generally one week

to three months. Advertising revenues on both banner and sponsorship contracts are recognized as

""impressions'' (i.e., the number of times that an advertisement appears in pages viewed by users of our

websites) are delivered or ratably over the term of the agreement where such agreements provide for

minimum monthly or quarterly advertising commitments or where such commitments are Ñxed throughout

the term. Barter transactions are valued based on amounts realized in similar cash transactions occurring

within six months prior to the date of the barter transaction. To the extent that signiÑcant delivery

obligations remain at the end of a period or collection of the resulting account receivable is not considered

probable, revenues are deferred until the obligation is satisÑed or the uncertainty is resolved. These

amounts are included in deferred revenue in our balance sheet. Third-party advertising net revenues,

including barter transactions, totaled 3%, 11% and 5% of our consolidated net revenues for the years ended

December 31, 2000, 2001 and 2002, respectively and were primarily from our U.S. segment. Revenue from

barter arrangements totaled $2.5 million in 2000, $10.4 million in 2001, and $10.1 million in 2002.

Third-party advertising revenues may be aÅected by the Ñnancial condition of our customers and by

the success of online promotions in general. Recently, the industry pricing of online advertisements has

deteriorated. Our third-party advertising revenue is dependent in signiÑcant part on the performance of

AOL Time Warner, Inc., or AOL, over which we do not have control. Reduction in third-party

advertising, whether due to softening of the demand for online advertising in general or particular problems

facing parties with whom we have contractual arrangements, would adversely aÅect our operating results.

Unlike our transaction revenues, third-party advertising revenues are derived from a highly concentrated

customer base. During the years ended December 31, 2000 and 2001, third-party advertising revenues were

all attributable to approximately 20 customers each year. During the year ended December 31, 2002, third-

party advertising revenues were all derived from approximately 30 customers. We continue to view our

business as primarily transaction driven and we expect third-party advertising revenues in future periods to

decrease as a percentage of total net revenues, and in absolute dollars. Additionally, our advertising sales

representative agreement with AOL has not been extended or renewed and is scheduled to terminate on

March 31, 2003, with AOL to continue its electronic delivery of our online advertisements for a speciÑed

wind-down period. After March 31, 2003, our third-party advertising revenues will be dependent on the

eÅorts of our existing internal sales staÅ.

End-to-End Services Revenues

Our end-to-end services revenues are derived principally from contractual arrangements with third

parties that provide transaction services to eBay users. To date, the duration of our end-to-end services

contracts has ranged from one to three years. End-to-end services revenues are recognized as the

contracted services are delivered to end-users. To the extent that signiÑcant obligations remain at the end

of a period or collection of the resulting receivable is not considered probable, revenues are deferred until

42