eBay 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

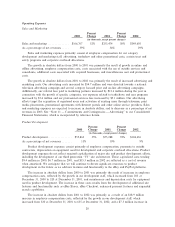

maintenance and depreciation costs for equipment used in research and development. The increase in these

costs results from the development of additional site features and functionality such as enhanced search

functionality, improved seller tools, expanded eBay Stores merchandising capabilities, added Ñxed price

functionality and improved site security. Product development expenses are expected to increase in

absolute dollars in 2003, as we develop new site features and functionality and continue to improve and

expand operations across all our segments. We expect product development expenses as a percentage of

net revenues in 2003 to remain generally consistent with 2002 levels.

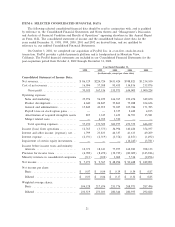

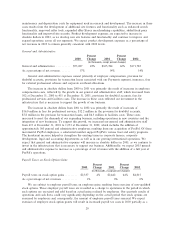

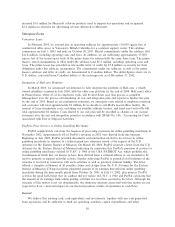

General and Administrative

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

General and administrative ÏÏÏÏÏÏÏÏÏÏ $73,027 45% $105,784 62% $171,785

As a percentage of net revenue ÏÏÏÏÏÏÏ 17% 14% 14%

General and administrative expenses consist primarily of employee compensation, provision for

doubtful accounts, provisions for transaction losses associated with our Payments segment, insurance, fees

for external professional advisors and corporate overhead allocations.

The increase in absolute dollars from 2000 to 2001 was primarily the result of increases in employee

compensation costs, reÖected by the growth in our general and administrative staÅ, which increased from

302 at December 31, 2000 to 415 at December 31, 2001, provisions for doubtful accounts, fees for

professional services and facilities costs. The increase in these costs reÖected our investment in the

infrastructure that is necessary to support the growth of our business.

The increase in absolute dollars from 2001 to 2002 was primarily the result of increases of

$16.0 million in fees for professional services, $12.2 million in the provision for doubtful accounts,

$7.8 million in the provision for transaction losses, and $6.5 million in facilities costs. These costs

increased to meet the demands of our expanding business, including operations in new countries and the

integration of new businesses. To support this growth, we increased our general and administrative staÅ

from 415 at December 31, 2001 to 1,253 at December 31, 2002, which includes the addition of

approximately 360 general and administrative employees resulting from our acquisition of PayPal. Of these

incremental PayPal employees, a substantial number support PayPal's various trust and safety programs.

The headcount increase helped us strengthen the existing teams in corporate Ñnance, corporate

development, legal and accounting departments as well as in our growing international operations. We

expect that general and administrative expenses will increase in absolute dollars in 2003, as we continue to

invest in the infrastructure that is necessary to support our business. Additionally, we expect 2003 general

and administrative expense to increase as a percentage of net revenues with the addition of a full year of

PayPal's operations.

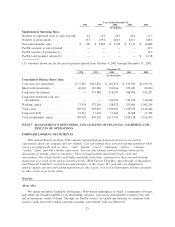

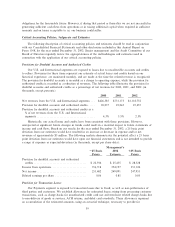

Payroll Taxes on Stock Option Gains

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Payroll taxes on stock option gains ÏÏÏÏÏÏÏÏÏ $2,337 4% $2,442 64% $4,015

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏ 1% 0% 0%

We are subject to employer payroll taxes on employee gains resulting from exercises of non-qualiÑed

stock options. These employer payroll taxes are recorded as a charge to operations in the period in which

such options are exercised and sold based on actual gains realized by employees. Our quarterly results of

operations and cash Öows could vary signiÑcantly depending on the actual period that stock options are

exercised by employees and, consequently, the amount of employer payroll taxes assessed. We expect

exercises of employee stock option grants will result in increased payroll tax costs in 2003 partially as a

29