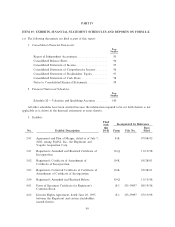

eBay 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

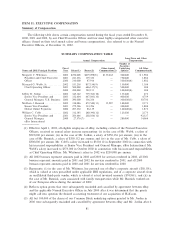

(3) Options were granted at an exercise price equal to the fair market value of our common stock, as

determined by the Board of Directors on the date of grant. The exercise prices per shares listed in the

table above are rounded to the nearest cent.

(4) ReÖects the value of the stock option on the date of grant assuming (i) for the 5% column, a 5%

annual rate of appreciation in our common stock over the ten-year term of the option and (ii) for the

10% column, a 10% annual rate of appreciation in our Common Stock over the ten-year term of the

option, in each case without discounting to net present value and before income taxes associated with

the exercise. The 5% and 10% assumed rates of appreciation are based on the rules of the SEC and

do not represent our estimate or projection of the future common stock price. The amounts in this

table may not necessarily be achieved.

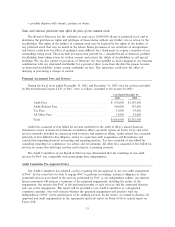

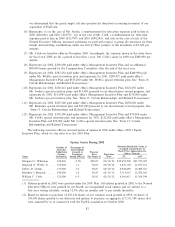

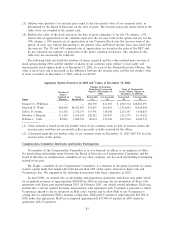

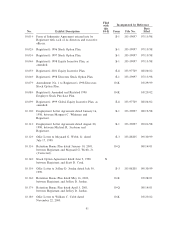

The following table sets forth the number of shares acquired and the value realized upon exercise of

stock options during 2002 and the number of shares of our common stock subject to exercisable and

unexercisable stock options held as of December 31, 2002, by each of the Named Executive OÇcers. The

value at Ñscal year end is measured as the diÅerence between the exercise price and the fair market value

at close of market on December 31, 2002, which was $67.82.

Aggregate Option Exercises in 2002 and Values at December 31, 2002

Number of Securities

Underlying Unexercised Value of Unexercised

Options at December 31, In-the-Money Options at

Number of 2002 December 31, 2002(2)

Shares

Acquired on Value Exercisable Unexercisable Exercisable Unexercisable

Name Exercise Realized(1) (#) (#) ($) ($)

Margaret C. Whitman ÏÏÏÏÏ Ì Ì 218,750 831,250 $ 4,947,734 $18,801,391

Maynard G. Webb ÏÏÏÏÏÏÏÏ 400,000 $6,922,607 474,035 465,965 11,714,025 10,443,840

JeÅrey D. JordanÏÏÏÏÏÏÏÏÏÏ 133,328 2,576,137 355,901 334,648 2,253,147 5,438,814

Matthew J. Bannick ÏÏÏÏÏÏÏ 113,329 2,106,234 220,832 247,497 1,312,179 4,155,422

William C. CobbÏÏÏÏÏÏÏÏÏÏ 85,000 1,898,718 86,874 233,126 2,057,054 4,942,533

(1) Value realized is based on the fair market value of our common stock on date of exercise minus the

exercise price and does not necessarily reÖect proceeds actually received by the oÇcer.

(2) Calculated using the fair market value of our common stock on December 31, 2002 ($67.82) less the

exercise price of the option.

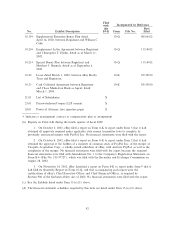

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is or was formerly an oÇcer or an employee of eBay.

No interlocking relationship exists between the Board of Directors or Compensation Committee and the

board of directors or compensation committee of any other company, nor has such interlocking relationship

existed in the past.

Mr. Kagle, a member of our Compensation Committee, is a member of the general partner of certain

venture capital funds that beneÑcially hold greater than 10% of the equity interests in Keen.com and

Vcommerce, Inc. We engaged in the following transactions with these companies in 2002:

In April 2000, we entered into an advertising and promotions agreement with Keen.com under which

we recognized revenues of approximately $200,000 in 2002 in exchange for our promotion of Keen. Our

agreement with Keen.com expired during 2002. In February 2001, our wholly owned subsidiary, Half.com,

entered into a certain content licensing and inventory sales agreement with Vcommerce pursuant to which

Vcommerce agreed to list its inventory on Half.com's website and to allow Half to use Vcommerce's

catalog data to supplement Half's existing catalog data. Half paid Vcommerce approximately $25,000 in

2002 under this agreement. Half has recognized approximately $17,000 of expense in 2003 under its

agreement with Vcommerce.

83