eBay 2002 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Making Payments

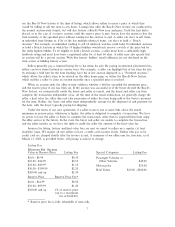

Senders make payments at the PayPal website, at an item listing on eBay or another online

marketplace where the seller has integrated PayPal's Instant Purchase Feature, or at the sites of merchants

that have integrated PayPal's Web Accept feature. To make a payment at PayPal's website, a sender logs

in to his or her account and enters the recipient's email address and the amount of the payment. To make

a payment through Instant Purchase or Web Accept, a sender selects an item for purchase, conÑrms the

payment information and enters his or her email address and password to authorize the payment. In both

scenarios, PayPal debits the money from the sender's PayPal balance, credit card or bank account and

instantly credits it to the recipient's PayPal balance in the case of an eCheck payment, the funds are

credited to the recipient's PayPal balance after two to three business days. In turn, the recipient can make

payments to others or withdraw his or her funds at any time via check, electronic funds transfer, or via the

PayPal debit card. PayPal earns revenues when an account receives a payment.

Funding Payments

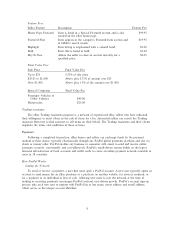

Senders fund payments in three ways:

‚ from the sender's existing PayPal balance;

‚ from the sender's bank account, using the Automated Clearing House, or ACH, network; or

‚ from the sender's credit card.

We incur funding costs on payments at varying levels based on the nature of the payment. To those

users who choose to maintain PayPal balances, we oÅer a money market rate of return on balances placed

in PayPal's Money Market Fund. The PayPal Money Market Fund, which is invested in a portfolio

managed by Barclays Global Fund Advisors, bore a current compound annual yield of 1.44% as of

December 31, 2002.

We use the terms ""balance'' and ""PayPal balance'' to refer to funds that PayPal customers choose

either to invest in the PayPal Money Market Fund (oÅered only to U.S. customers) or to authorize

PayPal to place in FDIC-insured pooled bank accounts as agent of PayPal's customers. These funds

belong to our customers and hence are not reÖected in our statement of Ñnancial position. Funds belonging

to our customers that are not invested in FDIC-insured accounts, such as funds in transit to or from the

customer's bank, are shown as a liability on our balance sheet.

VeriÑcation of PayPal's Account Holders

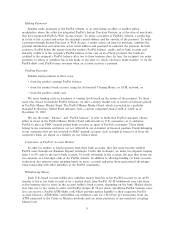

In order for senders to fund payments from their bank accounts, they Ñrst must become veriÑed

PayPal users through our Random Deposit technique. Under this technique, we make two deposits ranging

from 1 to 99 cents to the user's bank account. To verify ownership of the account, the user then enters the

two amounts as a four-digit code at the PayPal website. In addition to allowing funding via bank accounts,

veriÑcation also removes some spending limits on users' accounts and gives them reputational advantages

when transacting with other members of the PayPal community.

Withdrawing Money

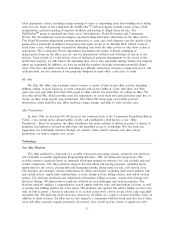

Each U.S.-based account holder may withdraw money from his or her PayPal account via an ACH

transfer to his or her bank account or by a mailed check from PayPal. ACH withdrawals may take three

to Ñve business days to arrive in the account holder's bank account, depending on the bank. Mailed checks

may take one to two weeks to arrive and PayPal charges $1.50 per check. Qualifying PayPal business users

also can receive a PayPal ATM/debit card, which provides instant liquidity to their respective PayPal

account balances. ATM/debit card holders can withdraw cash, for a $1.00 fee per transaction, from any

ATM connected to the Cirrus or Maestro networks and can make purchases at any merchant accepting

MasterCard.

9