eBay 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

From time to time, we are involved in disputes that arise in the ordinary course of business, and we

do not expect this trend to change in the future. We are currently involved in certain legal proceedings as

discussed in ""Item 3: Legal Proceedings'' and ""Note 11 Ì Commitments and Contingencies Ì Litigation''

to our Consolidated Financial Statements, which is incorporated by reference herein. We believe that we

have meritorious defenses to the claims against us, and we will defend ourselves vigorously. However, even

if successful, our defense against certain actions will be costly and could divert our management's time. If

the plaintiÅs were to prevail on certain claims, we might be forced to pay signiÑcant damages and

licensing fees, modify our business practices or even be prohibited from conducting a signiÑcant part of our

U.S. business. Any such results could materially harm our business and could result in a material adverse

impact on the Ñnancial position, results of operations or cash Öows of each of our three segments.

Accounting for Income Taxes

We are required to recognize a provision for income taxes based upon the taxable income and

temporary diÅerences for each of the tax jurisdictions in which we operate. This process requires a

calculation of taxes payable under currently enacted tax laws around the world and an analysis of

temporary diÅerences between the book and tax bases of our assets and liabilities, including various

accruals, allowances, depreciation and amortization. The tax eÅect of these temporary diÅerences and the

estimated tax beneÑt from our tax net operating losses are reported as deferred tax assets and liabilities in

our consolidated balance sheet. We also assess the likelihood that our net deferred tax assets will be

realized from future taxable income. To the extent we believe that it is more likely than not that some

portion of or all of the deferred tax asset will not be realized, we establish a valuation allowance. To the

extent we establish a valuation allowance or change the allowance in a period, we reÖect the change with a

corresponding increase or decrease in our tax provision in our income statement. Where the change in the

valuation allowance relates to the deduction for employee stock option exercises, the change is reÖected as

a credit to additional paid-in-capital. As employee stock option exercises are highly dependent upon the

performance of our stock price, it is extremely diÇcult to predict the amount of deductions that will be

generated from future option exercises and, therefore, it is diÇcult for us to ascertain the amount of

deferred tax assets related to employee stock option exercises that may be realized in future periods. We

have consequently provided a valuation allowance equal to 100% of our deferred tax assets related to

employee stock option exercises. The deferred tax asset, net of a valuation allowance of $145.2 million,

totaled $100.2 million at December 31, 2002. The following table illustrates the provision for income taxes

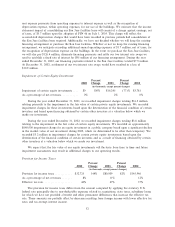

as a percentage of income before income taxes for 2000, 2001, and 2002 (in thousands, except percents):

2000 2001 2002

Income before income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $81,019 $170,457 $395,837

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 32,725 80,009 145,946

Provision for income taxes as a % of income before income

taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 40% 47% 37%

Historically, these provisions have adequately provided for our actual income tax liabilities. However,

unexpected or signiÑcant future changes in trends could result in a material impact to future statements of

income and cash Öows. Based on our results for the year ended December 31, 2002, a one-percentage

point change in our provision for income taxes as a percentage of income before taxes would have resulted

in an increase or decrease in expense of approximately $4.0 million. The following analysis demonstrates

the potential eÅect such a one-percentage point deviation change would have upon our Ñnancial statements

41