eBay 2002 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

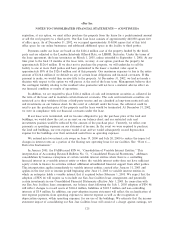

defendants' motion to transfer the case from the court where it was Ñled in Marshall, Texas to the Federal

District Court for the Southern District of Indiana. We believe that we have meritorious defenses and

intend to defend ourselves vigorously.

On February 20, 2002, PayPal was sued in California state court in a purported class action alleging

that its restriction of customer accounts and failure to promptly unrestrict legitimate accounts violates state

consumer protection law and is an unfair business practice and a breach of PayPal's User Agreement. This

action was reÑled with a diÅerent named plaintiÅ on June 6, 2002, and a related action was Ñled in the

U.S. District Court for the Northern District of California on the same day. On March 12, 2002, PayPal

was sued in the U.S. District Court for the Northern District of California in a purported class action

alleging that its restrictions of customer accounts and failure to promptly unrestrict legitimate accounts

violates federal and state consumer protection and unfair business practice law. The court has denied

PayPal's motion to compel individual arbitration as required by the PayPal User Agreement and has

invalidated that provision of the User Agreement. The two federal court actions have been consolidated

into a single case. PayPal is defending itself vigorously, but if it is unable to prevail in these lawsuits, it

may have to change its anti-fraud operations in a manner that will harm its business and pay substantial

damages. Even if its defense is successful, the litigation could damage PayPal's reputation, could require

signiÑcant management time, will be costly and could require changes to its customer service and

operations that could increase its costs and decrease the eÅectiveness of its anti-fraud program.

Three purported class action complaints were Ñled following announcement of the PayPal merger in

July 2002 in the court of Chancery in the State of Delaware in and for New Castle County by alleged

stockholders of PayPal. Two additional purported class action complaints were Ñled in the Superior Court

of the State of California, County of Santa Clara, by alleged PayPal stockholders. These complaints name

as defendants PayPal and each member of its board of directors as well as eBay. The complaints are

purported class actions that allege, among other things, that eBay controlled PayPal prior to the execution

of their merger agreement, the defendants breached Ñduciary duties they assertedly owed to PayPal's

stockholders in connection with PayPal entering into the merger agreement and the exchange ratio in the

merger is unfair and inadequate. The plaintiÅs seek, among other things, an award of unspeciÑed

compensatory damages. We believe that each of the lawsuits was without merit and intend to defend

ourselves vigorously.

Other third parties have from time to time claimed, and others may claim in the future that we have

infringed their past, current or future intellectual property rights. We have in the past been forced to

litigate such claims. We may become more vulnerable to such claims as laws such as the Digital

Millennium Copyright Act and Communications Decency Act are interpreted by the courts and as we

expand into jurisdictions where the underlying laws with respect to the potential liability of online

intermediaries like ourselves is less favorable. We expect that we will increasingly be subject to copyright

and trademark infringement claims as the geographical reach of our services expands. We also expect that

we will increasingly be subject to patent infringement claims as our services expand. In particular, we

expect that patent infringement claims involving various aspects of our Payments business will continue to

be made. We have been notiÑed of several potential disputes and are subject to a suit by Tumbleweed

Communications Corporation that is currently ongoing. These claims, whether meritorious or not, could be

time-consuming, result in costly litigation, cause service upgrade delays, require expensive changes in our

methods of doing business or could require us to enter into costly royalty or licensing agreements, if

available. As a result, these claims could harm our business.

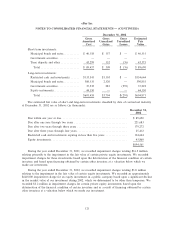

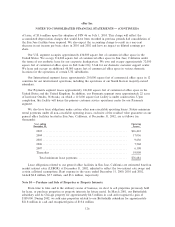

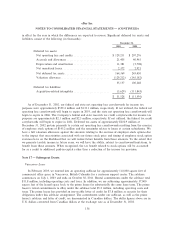

Capital Expenditures

In June 2002, we entered into an agreement to purchase computer equipment, software and related

services to expand our data warehousing capabilities. Under the agreement we are obligated to pay a

128