eBay 2002 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

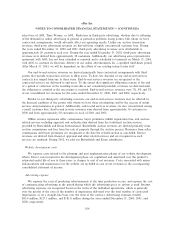

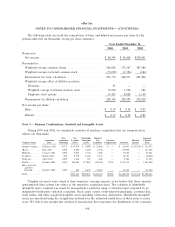

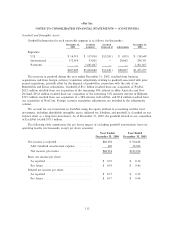

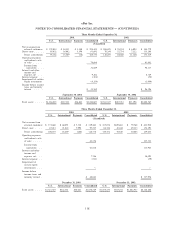

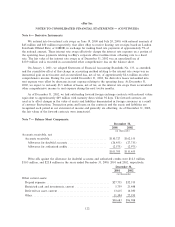

The components of acquired identiÑable intangible assets are as follows (in thousands):

December 31, 2001 December 31, 2002

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

Amount Amortization Amount Amount Amortization Amount

Intangible assets:

Developed

technologies ÏÏÏÏÏ $ 9,076 $(3,643) $ 5,433 $ 27,825 $ (8,353) $ 19,472

Customer listsÏÏÏÏÏÏ 6,525 (2,306) 4,219 208,811 (10,723) 198,088

TrademarksÏÏÏÏÏÏÏÏ 1,390 (350) 1,040 65,140 (3,235) 61,905

All other ÏÏÏÏÏÏÏÏÏÏ 973 (855) 118 733 (733) Ì

$17,964 $(7,154) $10,810 $302,509 $(23,044) $279,465

All of our acquired identiÑable intangible assets are subject to amortization. Acquired identiÑable

intangible assets are comprised of developed technologies, customer lists, trademarks, and other acquired

intangible assets including contractual agreements. Developed technologies are being amortized over a

weighted average period of approximately three years. Customer lists are being amortized over a weighted

average period of approximately seven years. Trademarks are being amortized over a weighted average

period of approximately seven years. No signiÑcant residual value is estimated for the intangible assets.

Aggregate amortization expense for intangible assets totaled $4.0 million and $16.3 million for the years

ended December 31, 2001 and 2002, respectively.

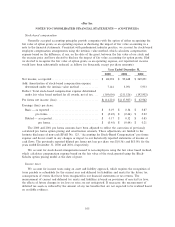

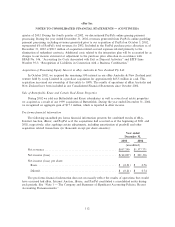

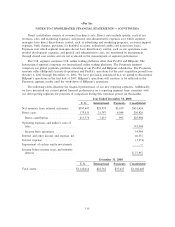

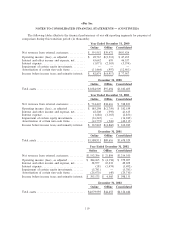

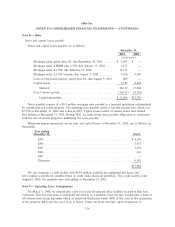

As of December 31, 2002, expected future intangible asset amortization expense is as follows (in

thousands):

Fiscal Years:

2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 47,555

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 47,052

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 43,844

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 38,297

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 37,212

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 65,505

$279,465

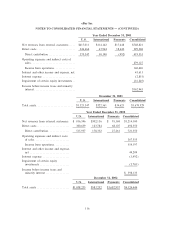

Note 4 Ì Segment Information:

Segment selection is based upon our internal organization structure, the manner in which our

operations are managed, the measurement of the performance of our operations evaluated by management

in the chief operating decision-maker capacity, the availability of separate Ñnancial information, and overall

materiality considerations.

During the fourth quarter of 2002, the growth of our international operations and our acquisition of

PayPal prompted us to change the basis for measuring our Ñnancial performance and evaluating resource

allocations, and therefore our reportable segments. We changed our business segments from Online and

OÉine services to U.S., International, and Payments operations. This new segment structure reÖects the

new composition of our business. Additionally, we changed the internal measurement basis of segment

performance from operating income before certain items to a direct contribution measure of proÑtability.

114