eBay 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

transaction losses incurred as of the reporting date, including those to which we have not yet been notiÑed.

The allowances are monitored monthly and are updated based on actual claims data reported by our

claims processors. Customers typically have up to 180 days to Ñle transaction disputes. Consequently, the

time between estimating the loss provisions and realization of the actual amount is short. The allowances

are based on known facts and circumstances, internal factors including our experience with similar cases,

historical trends involving loss payment patterns and the mix of transaction and loss types. Additions to the

allowance, in the form of provisions, are reÖected as a general and administrative expense in our results of

operations, while write-oÅs to the allowance are made when a loss is determined to have occurred.

Recoveries, when collected, are recorded as an increase to the allowance for transaction losses. As of

December 31, 2002, the allowance for transaction losses totaled $10.1 million and was included in other

current liabilities in our consolidated balance sheet.

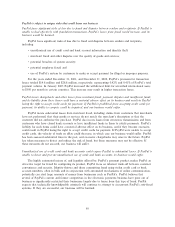

The following table illustrates the provision for transaction losses as a percentage of total payment

volume from PayPal operations for the post-acquisition period from October 4, 2002 through

December 31, 2002 (in thousands, except percents).

2002

Total Payment Volume from the PayPal operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $2,138,093

Provision for transaction losses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,832

Provision for transaction losses as a % of total payment volume from PayPal

operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.37%

Prior to our October 3, 2002 acquisition of PayPal, no provision for transaction losses was recorded as

our third-party banking service provider assumed all transaction loss exposure. The fees charged to us by

this banking service provider reÖected the assumption of this loss exposure and other services rendered.

Charges for the services were reported as a cost of net revenues.

The establishment of appropriate allowances for transaction losses is an inherently uncertain process,

and ultimate losses may vary from the current estimates. We regularly update our allowance estimates as

new facts become known and events occur that may impact the settlement or recovery of losses. The

allowances are maintained at a level deemed appropriate by management to adequately provide for losses

incurred at the balance sheet date. Based on our results for the post-acquisition period from October 4,

2002 through December 31, 2002, a Ñve basis point deviation from our estimates would have resulted in an

increase or decrease in expense of approximately $1.0 million. The following analysis demonstrates the

potential eÅect a Ñve basis point deviation from our estimates would have upon our Ñnancial statements

for the period that we consolidated PayPal's operations and is not intended to provide a range of exposure

or expected deviation (in thousands, except per share data):

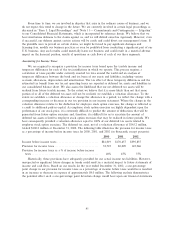

Management's

¿5 Basis 2002 °5 Basis

Points Estimate Points

Provision for transaction losses ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 6,842 $ 7,832 $ 8,980

Income from operationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 355,187 354,197 353,049

Net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 250,516 249,891 249,166

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.86 0.85 0.85

Legal Contingencies

In connection with certain pending litigation and other claims, we have estimated the range of

probable loss and provided for such losses through charges to our income statement. These estimates have

been based on our assessment of the facts and circumstances at each balance sheet date and are subject to

change based upon new information and future events.

40