eBay 2002 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

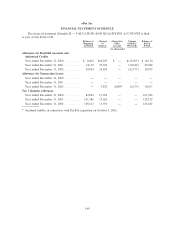

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

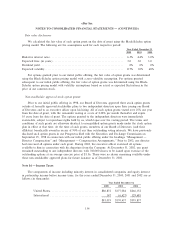

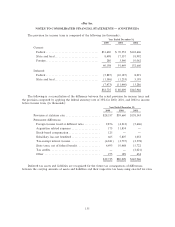

in eÅect for the year in which the diÅerences are expected to reverse. SigniÑcant deferred tax assets and

liabilities consist of the following (in thousands):

December 31,

2001 2002

Deferred tax assets:

Net operating loss and credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 129,211 $ 207,276

Accruals and allowances ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,405 40,941

Depreciation and amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,381 (5,708)

Net unrealized lossesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,372 2,921

Net deferred tax assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 164,369 245,430

Valuation allowanceÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (129,212) (145,182)

35,157 100,248

Deferred tax liabilities:

Acquisition-related intangibles ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3,629) (111,843)

$ 31,528 $ (11,595)

As of December 31, 2002, our federal and state net operating loss carryforwards for income tax

purposes were approximately $559.4 million and $133.1 million, respectively. If not utilized, the federal net

operating loss carryforwards will begin to expire in 2019, and the state net operating loss carryforwards will

begin to expire in 2006. The Company's federal and state research tax credit carryforwards for income tax

purposes are approximately $2.1 million and $2.3 million, respectively. If not utilized, the federal tax credit

carryforwards will begin to expire in 2021. Deferred tax assets of approximately $202.9 million at

December 31, 2002 pertain primarily to certain net operating loss carryforwards resulting from the exercise

of employee stock options of $145.2 million and the remainder relates to losses at certain subsidiaries. We

have a full valuation allowance against the amounts relating to the exercise of employee stock options due

to the impact that uncertainties associated with our future stock price and timing of employee stock option

exercises have on the likelihood that we will realize future beneÑts from these amounts. To the extent that

we generate taxable income in future years, we will have the ability, subject to carryforward limitations, to

beneÑt from these amounts. When recognized, the tax beneÑt related to stock options will be accounted

for as a credit to additional paid-in-capital rather than a reduction of the income tax provision.

Note 17 Ì Subsequent Events:

Vancouver Lease

In February 2003, we entered into an operating sublease for approximately 110,000 square feet of

commercial oÇce space in Vancouver, British Columbia for a customer support center. The sublease

commences on July 1, 2003 and ends on October 30, 2011. Rental commitments under the sublease total

$11.8 million, including operating costs and taxes. In addition, we are subleasing approximately 37,000

square feet of the leased space back to the prime lessee for substantially the same lease term. The prime

lessee's rental commitments to eBay under the sublease total $5.2 million, including operating costs and

taxes. The prime lessee has provided an irrevocable letter of credit for $7.8 million as security for their

obligations under this sublease arrangement. The commitment under our sublease, as well as the prime

lessee's sublease and letter of credit, are denominated in Canadian dollars. The dollar Ñgures above are in

U.S. dollars converted from Canadian dollars at the exchange rate as of December 31, 2002.

136