eBay 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

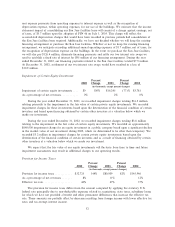

expense payments from operating expenses to interest expense as well as the recognition of depreciation

expense, within operating expenses, for our use of the buildings. We estimate that the income statement

impact of consolidating our San Jose facilities lease will consist of a charge against earnings, net of taxes,

of $5.6 million upon the adoption of FIN 46 on July 1, 2003. This charge will reÖect the accumulated

depreciation charges that would have been recorded in previous periods had consolidation of the San Jose

facilities been required. Additionally, we have not decided whether we will keep the existing Ñnancing

arrangement or purchase the San Jose facilities. Whether or not we keep the existing Ñnancing

arrangement, we anticipate recording additional annual operating expenses of $1.7 million, net of taxes, for

the recognition of depreciation expense on the buildings. In the event we purchase the San Jose facilities,

we will also pay $126.4 million, eliminate Ñnancing payments and settle our two interest rate swaps we

used to establish a Ñxed rate of interest for $95 million of our Ñnancing arrangement. During the year

ended December 31, 2002, our Ñnancing payments related to the San Jose facilities totaled $7.9 million.

At December 31, 2002, settlement of our two interest rate swaps would have resulted in a loss of

$10.9 million.

Our U.S. segment occupies approximately 434,000 square feet of commercial oÇce space in the

United States. We occupy 314,000 square feet of commercial oÇce space in San Jose, California under

the terms of our synthetic lease for our corporate headquarters. We own and occupy approximately 72,000

square feet of commercial oÇce space in Salt Lake City, Utah for our domestic customer support center.

We lease and occupy an additional 48,000 square feet of commercial oÇce space in various domestic

locations for the operations of certain U.S. subsidiaries.

Our International segment leases approximately 210,000 square feet of commercial oÇce space in

12 countries for our international operations, including the operations of our South Korean majority-owned

subsidiary.

Our Payments segment leases approximately 126,000 square feet of commercial oÇce space in the

United States and the United Kingdom. In addition, our Payments segment owns approximately 22 acres

of land near Omaha, Nebraska, on which a 115,000 square foot facility is under construction. Upon

completion, this facility will house the primary customer service operations center for our Payments

segment.

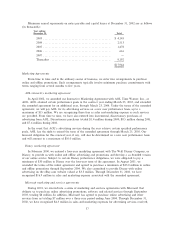

We also have lease obligations under certain other non-cancelable operating leases. Future minimum

rental payments under all non-cancelable operating leases, exclusive of the residual value guarantee on our

general oÇce facilities located in San Jose, California, at December 31, 2002 are as follows (in

thousands):

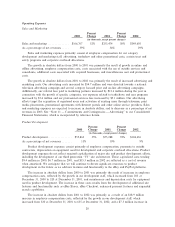

Year Ending Operating

December 31, Leases

2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $16,410

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,056

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,630

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,568

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,108

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 19,909

Total minimum lease payments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $76,681

36