eBay 2002 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

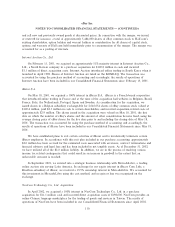

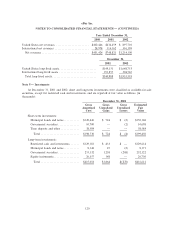

EachNet, Inc. Equity Investment

On March 17, 2002, we acquired a 38% interest in the outstanding common stock of EachNet, Inc.,

which is a 33% interest on a fully diluted basis, in a purchase acquisition for $30.0 million in cash.

EachNet provides an online marketplace for the trading of goods and services for both individual and

business customers in the People's Republic of China.

We account for our investment in EachNet using the equity method of accounting and the total

investment, including identiÑable intangible assets, deferred tax liabilities and goodwill, is classiÑed on our

balance sheet as a long-term investment. In periods subsequent to the acquisition, our consolidated

Ñnancial results include 38% of the net income or loss of EachNet together with amortization expense

relating to acquired intangible assets.

PayPal, Inc. Merger

On October 3, 2002, we acquired a 100% interest in PayPal, Inc. in a tax-free, stock-for-stock

transaction. PayPal provides a global payments platform and is headquartered in Mountain View,

California. We acquired PayPal to provide a signiÑcantly improved customer experience to eBay's users by

making their trading experience easier, safer, and faster. The PayPal Ñnancial statements are included in

our Consolidated Financial Statements for the post-acquisition period from October 4, 2002 through

December 31, 2002.

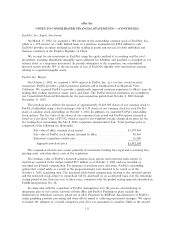

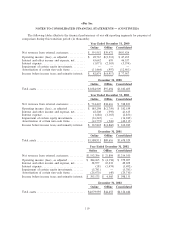

The purchase price reÖects the issuance of approximately 23,825,000 shares of our common stock to

PayPal stockholders using a Ñxed exchange ratio of 0.39 shares of our common stock for each PayPal

share of common stock outstanding on October 3, 2002. In addition, we assumed PayPal's outstanding

stock options. The fair value of the shares of our common stock issued and PayPal options assumed is

based on a per share value of $57.92, which is equal to our weighted average closing share price for the

Ñve trading days surrounding the July 8, 2002 acquisition announcement date. Total purchase price is

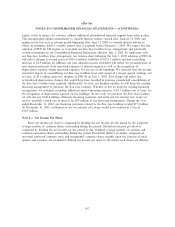

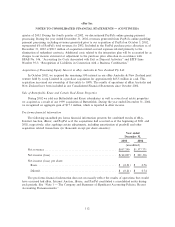

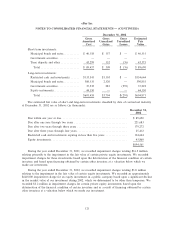

comprised of the following (in thousands):

Fair value of eBay common stock issued ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,379,944

Fair value of PayPal stock options assumed by eBay ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 96,560

Estimated acquisition related costs ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 16,000

Aggregate purchase price ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,492,504

The acquisition related costs consist primarily of investment banking fees, legal and accounting fees,

printing costs, and other direct costs of the acquisition.

The intrinsic value of PayPal's unvested common stock options and restricted stock subject to

repurchase assumed in the merger totaled $9.9 million as of October 3, 2002 and was recorded as

unearned stock-based compensation. For purposes of purchase price allocation, PayPal's outstanding

options that vested solely as a result of the proposed merger were deemed to be vested as of the

October 3, 2002 acquisition date. The unearned stock-based compensation relating to the unvested options

and the restricted stock subject to repurchase will be amortized on an accelerated basis over the remaining

vesting period of less than one year to three years, consistent with the graded vesting approach described in

FASB Interpretation No. 28.

In connection with the acquisition of PayPal, management is in the process of formalizing an

integration plan to exit certain activities of both eBay and PayPal. Preliminary plans include the

elimination of redundant contracts, phase-out of eBay Payments by BillPoint, discontinuance of PayPal's

online gambling payment processing and other eÅorts aimed at achieving operational synergies. We expect

to Ñnalize the adoption of a formal integration plan after our assessment is complete, likely in the second

111