eBay 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

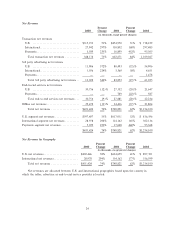

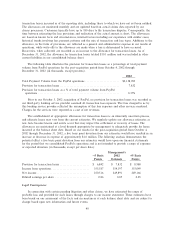

Non-Operating Items

Interest and Other Income, Net

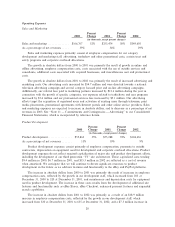

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Interest and other income, netÏÏÏÏÏÏÏÏÏÏ $46,337 (10)% $41,613 18% $49,209

As a percentage of net revenues ÏÏÏÏÏÏÏÏ 11% 6% 4%

Interest and other income, net consists of interest earned on cash, cash equivalents, and investments

as well as foreign exchange transaction gains and losses and other miscellaneous non-operating

transactions.

Our interest and other income, net decreased during 2001 as a result of a lower interest rate

environment. Our weighted-average interest rate was approximately 4.3% in 2000 and 3.6% in 2001.

Although, we maintained higher cash, cash equivalent and investment balances during 2001 as a result of

increased operating and Ñnancing cash Öows, the decrease in interest rates resulted in an overall decline in

interest income.

Our interest and other income, net increased during 2002 primarily as a result of gains from the sale

of our ButterÑelds subsidiary and certain real estate properties of $10.6 million, a gain on the sale of our

Kruse subsidiaries of $6.5 million and a gain on the sale of an equity investment in a privately held

company of $3.2 million. These gains were oÅset by a decrease in interest and investment income of

$4.1 million resulting from lower average interest rates, despite an increase in our cash, cash equivalents,

and investments balances in 2002 and from decreased realized gains on the sale of investments, and a

decrease in foreign exchange gains of $3.5 million. Our weighted-average interest rate was approximately

3.6% in 2001 and 2.8% in 2002. We expect that interest and other income, net will decrease in 2003, as we

do not expect signiÑcant gains from the sale of assets or subsidiaries in 2003.

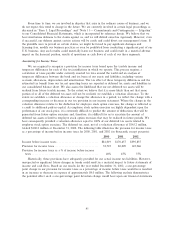

Interest Expense

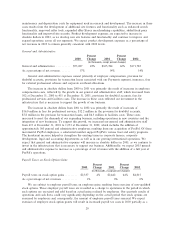

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Interest expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $3,374 (16)% $2,851 (48)% $1,492

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏ 1% 0% 0%

Interest expense consists of interest charges on mortgage notes and capital leases. Interest expense

decreased from 2000 to 2001, as a result of lower interest rates and a reduction in outstanding debt

balances. Interest expense decreased from 2001 to 2002 as a result of a reduction in the outstanding

mortgage notes balances in connection with the sale of several of the underlying properties.

In January 2003, the FASB issued FIN No. 46, ""Consolidation of Variable Interest Entities.'' This

interpretation of Accounting Research Bulletin No. 51, ""Consolidated Financial Statements,'' addresses

consolidation by business enterprises of certain variable interest entities where there is a controlling

Ñnancial interest in a variable interest entity or where the variable interest entity does not have suÇcient

equity at risk to Ñnance its activities without additional subordinated Ñnancial support from other parties.

This interpretation applies immediately to variable interest entities created after January 31, 2003 and

applies in the Ñrst year or interim period beginning after June 15, 2003 to variable interest entities in

which an enterprise holds a variable interest that it acquired before February 1, 2003. We expect that the

adoption of FIN 46 will require us to include our San Jose facilities lease arrangement and potentially

certain investments in our Consolidated Financial Statements eÅective July 1, 2003. In connection with

our San Jose facilities lease arrangement, our balance sheet following the July 1, 2003 adoption of FIN 46

will reÖect changes to record assets of $126.4 million, liabilities of $122.5 million and non-controlling

interests of $3.9 million. In addition, our post-adoption income statement will reÖect the reclassiÑcation of

31