eBay 2002 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

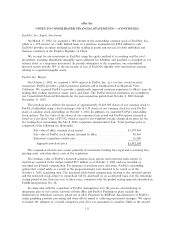

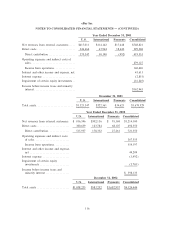

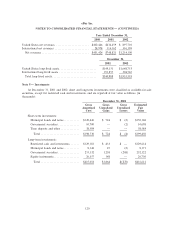

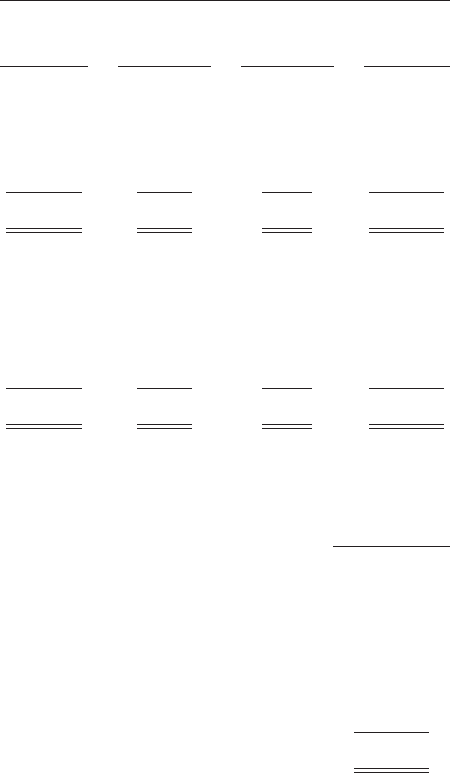

December 31, 2002

Gross Gross Gross Estimated

Amortized Unrealized Unrealized Fair

Cost Gains Losses Value

Short-term investments:

Municipal bonds and notes ÏÏÏÏÏÏÏÏÏÏÏ $ 46,158 $ 157 $ Ì $ 46,315

Government securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì

Time deposits and other ÏÏÏÏÏÏÏÏÏÏÏÏÏ 43,299 152 (76) 43,375

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 89,457 $ 309 $ (76) $ 89,690

Long-term investments:

Restricted cash and investments ÏÏÏÏÏÏ $133,541 $1,103 $ Ì $134,644

Municipal bonds and notes ÏÏÏÏÏÏÏÏÏÏÏ 388,535 2,320 Ì 390,855

Government securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 35,232 281 (291) 35,222

Equity instrumentsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 44,150 Ì Ì 44,150

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $601,458 $3,704 $(291) $604,871

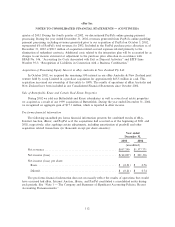

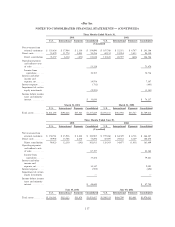

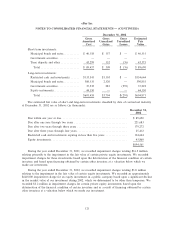

The estimated fair value of short and long-term investments classiÑed by date of contractual maturity

at December 31, 2002 are as follows (in thousands):

December 31,

2002

Due within one year or lessÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 89,690

Due after one year through two years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 221,683

Due after two years through three years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 179,272

Due after three years through four years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 25,412

Restricted cash and investments expiring in less than Ñve years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 134,644

Equity investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 43,860

$694,561

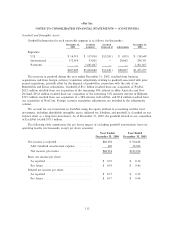

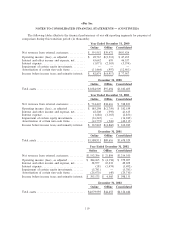

During the year ended December 31, 2001, we recorded impairment charges totaling $16.2 million

relating primarily to the impairment in the fair value of certain private equity investments. We recorded

impairment charges for these investments based upon the deterioration of the Ñnancial condition of certain

investees and based upon Ñnancing obtained by certain other investees at a valuation below which we

made our investment.

During the year ended December 31, 2002, we recorded impairment charges totaling $3.8 million

relating to the impairment in the fair value of certain equity investments. We recorded an approximately

$640,000 impairment charge for an equity investment in a public company based upon a signiÑcant decline

in the market value of our investment during 2002, which we determined to be other than temporary. We

recorded $3.2 million in impairment charges for certain private equity investments based upon the

deterioration of the Ñnancial condition of certain investees and as a result of Ñnancing obtained by certain

other investees at a valuation below which we made our investment.

121