eBay 2002 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

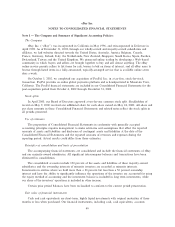

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

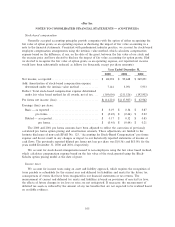

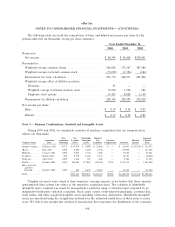

Stock-based compensation

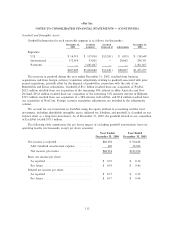

Generally accepted accounting principles provide companies with the option of either recognizing the

fair value of option grants as an operating expense or disclosing the impact of fair value accounting in a

note to the Ñnancial statements. Consistent with predominant industry practice, we account for stock-based

employee compensation arrangements using the intrinsic value method, which calculates compensation

expense based on the diÅerence, if any, on the date of the grant, between the fair value of our stock and

the exercise price and have elected to disclose the impact of fair value accounting for option grants. Had

we elected to recognize the fair value of option grants as an operating expense, our reported net income

would have been substantially reduced, as follows (in thousands, except per share amounts):

Year Ended December 31,

2000 2001 2002

Net income, as reportedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 48,294 $ 90,448 $ 249,891

Add: Amortization of stock-based compensation expense

determined under the intrinsic value method ÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,141 3,091 5,953

Deduct: Total stock-based compensation expense determined

under fair value based method for all awards, net of tax ÏÏÏÏ (169,656) (211,526) (192,902)

Pro forma net income (loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(114,221) $(117,987) $ 62,942

Earnings (loss) per share:

Basic Ì as reported ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.19 $ 0.34 $ 0.87

pro forma ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (0.45) $ (0.44) $ 0.22

Diluted Ì as reportedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.17 $ 0.32 $ 0.85

pro formaÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (0.45) $ (0.44) $ 0.21

The 2000 and 2001 pro forma amounts have been adjusted to reÖect the correction of previously

calculated pro forma option pricing and amortization amounts. These adjustments are limited to the

footnote disclosure of non-cash SFAS No. 123, ""Accounting for Stock-Based Compensation'' pro forma

expense and do not result in any changes or impact to our historically reported statements of income or

cash Öows. The previously reported diluted pro forma net loss per share was $(0.36) and $(0.05) for the

years ended December 31, 2000 and 2001, respectively.

We account for stock-based arrangements issued to non-employees using the fair value based method,

which calculates compensation expense based on the fair value of the stock granted using the Black-

Scholes option pricing model at the date of grant.

Income taxes

We account for income taxes using an asset and liability approach, which requires the recognition of

taxes payable or refundable for the current year and deferred tax liabilities and assets for the future tax

consequences of events that have been recognized in our Ñnancial statements or tax returns. The

measurement of current and deferred tax assets and liabilities is based on provisions of enacted tax laws;

the eÅects of future changes in tax laws or rates are not anticipated. If necessary, the measurement of

deferred tax assets is reduced by the amount of any tax beneÑts that are not expected to be realized based

on available evidence.

105