eBay 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

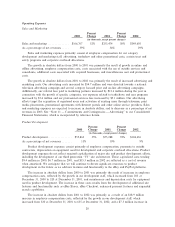

rent expense payments from operating expenses to interest expense as well as the recognition of

depreciation expense, within operating expenses, for our use of the buildings. We estimate that the income

statement impact of consolidating our San Jose facilities lease will consist of a charge against earnings, net

of taxes, of $5.7 million upon the adoption of FIN 46 on July 1, 2003. This charge will reÖect the

accumulated depreciation charges that would have been recorded in previous periods had consolidation of

the San Jose facilities been required. Additionally, we have not decided whether we will keep the existing

Ñnancing arrangement or purchase the San Jose facilities. Whether or not we keep the existing Ñnancing

arrangement, we anticipate recording additional annual operating expenses of $1.7 million, net of taxes, for

the recognition of depreciation expense on the buildings. In the event we purchase the San Jose facilities,

we will also pay $126.4 million, eliminate Ñnancing payments and settle our two interest rate swaps we

used to establish a Ñxed rate of interest for $95 million of our Ñnancing arrangement. During the year

ended December 31, 2002, our Ñnancing payments related to the San Jose facilities totaled $7.9 million.

At December 31, 2002, settlement of our two interest rate swaps would have resulted in a loss of

$10.9 million.

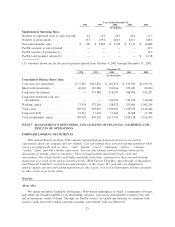

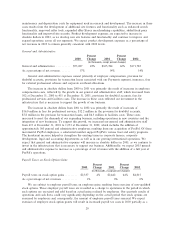

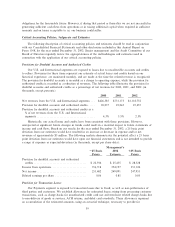

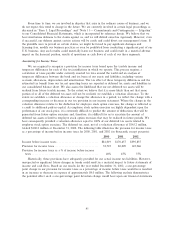

Impairment of Certain Equity Investments

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Impairment of certain equity investments ÏÏÏÏ $0 100% $16,245 (77)% $3,781

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏ 0% 2% 0%

During the year ended December 31, 2001, we recorded impairment charges totaling $16.2 million

relating primarily to the impairment in the fair value of certain private equity investments. We recorded

impairment charges for these investments based upon the deterioration of the Ñnancial condition of certain

investees and based upon Ñnancing obtained by certain other investees at a valuation below which we

made our investment.

During the year ended December 31, 2002, we recorded impairment charges totaling $3.8 million

relating to the impairment in the fair value of certain equity investments. We recorded an approximately

$640,000 impairment charge for an equity investment in a public company based upon a signiÑcant decline

in the market value of our investment during 2002, which we determined to be other than temporary. We

recorded $3.2 million in impairment charges for certain private equity investments based upon the

deterioration of the Ñnancial condition of certain investees and as a result of Ñnancing obtained by certain

other investees at a valuation below which we made our investment.

We expect that the fair value of our equity investments will Öuctuate from time to time and future

impairment assessments may result in additional charges to our operating results.

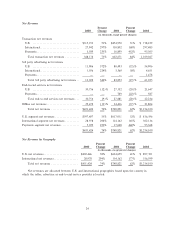

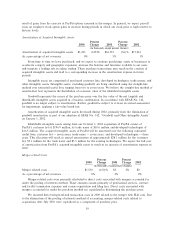

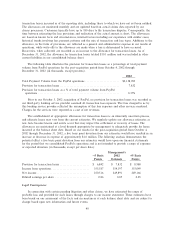

Provision for Income Taxes

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Provision for income taxes ÏÏÏÏÏÏÏÏÏÏÏÏ $32,725 144% $80,009 82% $145,946

As a percentage of net revenues ÏÏÏÏÏÏÏ 8% 11% 12%

EÅective tax rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 40% 47% 37%

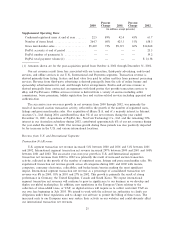

The provision for income taxes diÅers from the amount computed by applying the statutory U.S.

federal rate principally due to non-deductible expenses related to acquisitions, state taxes, subsidiary losses

for which we have not provided a beneÑt and other permanent diÅerences that increase the eÅective tax

rate. These amounts are partially oÅset by decreases resulting from foreign income with lower eÅective tax

rates and tax-exempt interest income.

32