eBay 2002 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

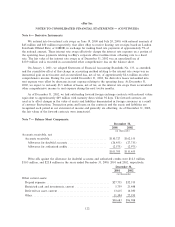

of taxes, of $5.6 million upon the adoption of FIN 46 on July 1, 2003. This charge will reÖect the

accumulated depreciation charges that would have been recorded in previous periods had consolidation of

the San Jose facilities been required. We also expect the accounting change to result in a one-cent

decrease in net income per basic share in 2001 and 2002 and have no impact on diluted earnings per

share.

Our U.S. segment occupies approximately 434,000 square feet of commercial oÇce space in the

United States. We occupy 314,000 square feet of commercial oÇce space in San Jose, California under

the terms of our synthetic lease for our corporate headquarters. We own and occupy approximately 72,000

square feet of commercial oÇce space in Salt Lake City, Utah for our domestic customer support center.

We lease and occupy an additional 48,000 square feet of commercial oÇce space in various domestic

locations for the operations of certain U.S. subsidiaries.

Our International segment leases approximately 210,000 square feet of commercial oÇce space in 12

countries for our international operations, including the operations of our South Korean majority-owned

subsidiary.

Our Payments segment leases approximately 126,000 square feet of commercial oÇce space in the

United States and the United Kingdom. In addition, our Payments segment owns approximately 22 acres

of land near Omaha, Nebraska, on which a 115,000 square foot facility is under construction. Upon

completion, this facility will house the primary customer service operations center for our Payments

segment.

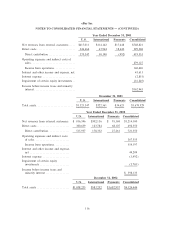

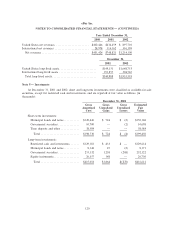

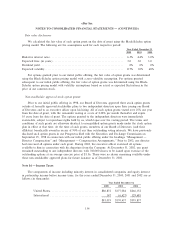

We also have lease obligations under certain other non-cancelable operating leases. Future minimum

rental payments under all non-cancelable operating leases, exclusive of the residual value guarantee on our

general oÇce facilities located in San Jose, California, at December 31, 2002, are as follows (in

thousands):

Year ending Operating

December 31, Leases

2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $16,410

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,056

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,630

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,568

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,108

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 19,909

Total minimum lease payments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $76,681

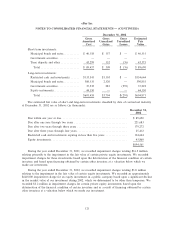

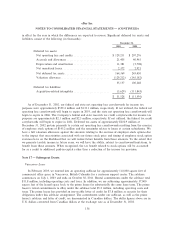

Lease obligations related to our general oÇce facilities in San Jose, California are estimated based on

market interest rates (LIBOR) at December 31, 2002, adjusted to reÖect the two interest rate swaps and

certain collateral assumptions. Rent expense in the years ended December 31, 2000, 2001 and 2002,

totaled $4.8 million, $5.7 million, and $3.6 million, respectively.

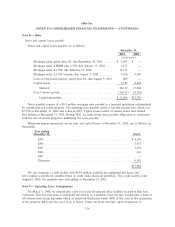

Note 10 Ì Purchase and Sale of Properties or Property Interests:

From time to time and in the ordinary course of business, we elect to sell properties previously held

for lease, or purchase properties or property interests for future rental. In March 2001, our ButterÑelds

subsidiary sold its Chicago property for approximately $4.5 million in cash and recognized a gain of

$189,000. During 2002, we sold nine properties related to our ButterÑelds subsidiary for approximately

$21.8 million in cash and recognized gains of $10.6 million.

126