eBay 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity and Capital Resources

Cash Flows

Since inception, we have Ñnanced operations primarily from net cash generated from operating

activities. In addition, we have obtained additional Ñnancing from the sale of preferred stock and warrants,

proceeds from the exercise of those warrants, proceeds from the exercise of stock options and proceeds

from our initial and follow-on public oÅerings. During 2002, we were primarily Ñnanced by our income

from operations and from the proceeds of stock option exercises.

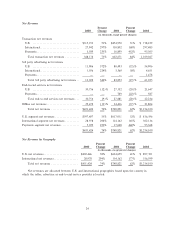

Net cash provided by operating activities was $100.1 million in 2000, $252.1 million in 2001, and

$479.9 million in 2002. Net cash provided by operating activities resulted primarily from our net income,

tax beneÑts on the exercise of stock options, non-cash charges for depreciation and amortization and

changes in assets and liabilities.

Net cash used in investing activities was $206.1 million in 2000, $29.8 million in 2001, and

$157.8 million in 2002. The primary use for invested cash in the periods presented was for purchases of

property and equipment and acquisitions, net of proceeds from the sale of investments and assets.

Net cash provided by Ñnancing activities was $86.0 million in 2000, $101.5 million in 2001, and

$252.1 million in 2002. Net cash provided by Ñnancing activities was primarily due to the issuance of

common stock associated with stock option exercises.

Commitments and Contingencies

Capital Expenditures

We expect capital expenditures to approximate $200 million during 2003, without taking into account

any acquisitions or costs associated with the potential purchase of additional oÇce facilities, and consists

primarily of hardware and software for our platform architecture, site operations and corporate information

systems. In the event we purchase additional oÇce facilities in 2003, our capital expenditures would be

substantially larger. As of December 31, 2002, we have commitments to purchase a total of $28.8 million

in computer equipment, software and related services from two vendors.

In June 2002, we entered into an agreement to purchase computer equipment, software and related

services to expand our data warehousing capabilities. Under the agreement we are obligated to pay a

minimum of $16.0 million to a third-party vendor during a 30-month period ending in December 2004.

Minimum purchases under the commitment total $7.2 million in 2002, $4.5 million in 2003, and

$4.3 million in 2004. During the year ended December 31, 2002, we purchased $8.6 million under this

contract.

In December 2002, we entered into an agreement to purchase computer equipment, software and

related services to further expand our platform architecture, site operations and corporate information

systems. Under the agreement, we are obligated to pay a minimum of $20.0 million to a third-party vendor

during 2003. The commitment may include a maximum of $5.4 million in services purchases, and the

remainder must consist of equipment and software purchases. The agreement automatically renews for

additional one-year periods through 2005, if we do not cancel the agreement at the conclusion of each

year. In addition, this vendor amended an existing promotions agreement and has agreed to pay us

$5.0 million in quarterly payments for promotion of its auctions on eBay.com in 2003 and to spend an

additional $666,000 in joint promotions during the year. The promotions agreement, as amended, can be

renewed with the mutual agreement of both parties for additional one-year terms through 2005.

Equipment, software and services purchases will be expensed or capitalized in accordance with our

capitalization policy. Promotions will be recognized as transaction revenue over the period of delivery.

34