eBay 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

obligations for the foreseeable future. However, if during that period or thereafter we are not successful in

generating suÇcient cash Öows from operations or in raising additional capital when required in suÇcient

amounts and on terms acceptable to us, our business could suÅer.

Critical Accounting Policies, Judgments and Estimates

The following description of critical accounting policies and estimates should be read in conjunction

with our Consolidated Financial Statements and other disclosures included in this Annual Report on

Form 10-K for the year ended December 31, 2002. Senior management and the Audit Committee of our

Board of Directors regularly review the appropriateness of the methodologies and estimates used in

connection with the application of our critical accounting policies.

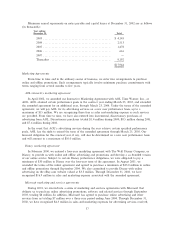

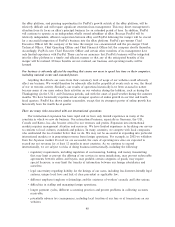

Provisions for Doubtful Accounts and Authorized Credits

Our U.S. and International segments are exposed to losses due to uncollectible accounts and credits

to sellers. Provisions for these items represent our estimate of actual losses and credits based on our

historical experience, are monitored monthly, and are made at the time the related revenue is recognized.

The provision for doubtful accounts is recorded as a charge to operating expense, while the provision for

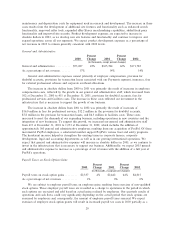

authorized credits is recorded as a reduction of revenues. The following table illustrates the provision for

doubtful accounts and authorized credits as a percentage of net revenues for 2000, 2001, and 2002 (in

thousands, except percents).

2000 2001 2002

Net revenues from the U.S. and International segments ÏÏÏ $426,385 $731,173 $1,118,732

Provision for doubtful accounts and authorized credits ÏÏÏÏÏ 18,237 25,243 25,455

Provision for doubtful accounts and authorized credits as a

% of net revenues from the U.S. and International

segments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4.3% 3.5% 2.3%

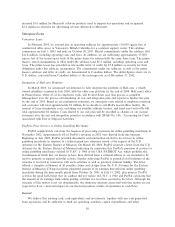

Historically, our actual losses and credits have been consistent with these provisions. However,

unexpected or signiÑcant future changes in trends could result in a material impact to future statements of

income and cash Öows. Based on our results for the year ended December 31, 2002, a 25 basis point

deviation from our estimates would have resulted in an increase or decrease in expense and/or net

revenues of approximately $3 million. The following analysis demonstrates the potential eÅect a 25 basis

point deviation from our estimates would have upon our Ñnancial statements and is not intended to provide

a range of exposure or expected deviation (in thousands, except per share data):

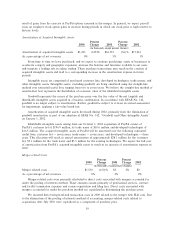

Management's

¿25 Basis 2002 °25 Basis

Points Estimate Points

Provision for doubtful accounts and authorized

credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 22,934 $ 25,455 $ 28,528

Income from operationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 356,718 354,197 351,124

Net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 251,482 249,891 247,951

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.86 0.85 0.85

Provision for Transaction Losses

Our Payments segment is exposed to transaction losses due to fraud, as well as non-performance of

third parties and customers. We establish allowances for estimated losses arising from processing customer

transactions, such as charge-backs for unauthorized credit card use and merchant related charge-backs due

to non-delivery of goods or services, ACH returns, and debit card overdrafts. These allowances represent

an accumulation of the estimated amounts, using an actuarial technique, necessary to provide for

39