eBay 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

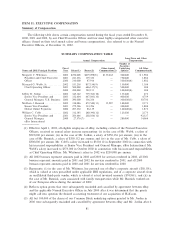

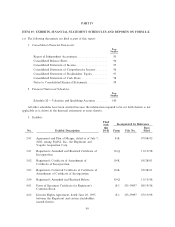

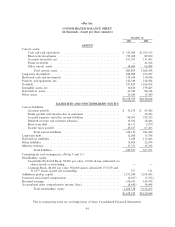

Equity Compensation Plan Information

The following table gives information about our shares of common stock that may be issued upon the

exercise of options, warrants and rights under all of our existing equity compensation plans as of

December 31, 2002, including our 1996 Stock Option Plan, 1997 Stock Option Plan, 1998 Equity

Incentive Plan, 1998 Directors Stock Option Plan, the 1999 Plan, the 2001 Plan as well as shares of our

common stock that may be issued under individual compensation arrangements that were not approved by

our stockholders, also referred to as our Non-Plan Grants. No warrants or rights are outstanding under any

of the foregoing plans.

(c)

(a) Number of Securities

Number of Securities (b) Remaining Available for

to Be Issued upon Weighted Average Future Issuance under

Exercise Exercise Price of Equity Compensation Plans

of Outstanding Options, Outstanding Options, (Excluding Securities

Plan Category Warrants and Rights Warrants and Rights ReÖected in Column(a))

Equity compensation plans

approved by

securityholdersÏÏÏÏÏÏÏÏÏ 34,722,006 $56.27 22,238,406(1)

Equity compensation plans

not approved by

securityholdersÏÏÏÏÏÏÏÏÏ 780,000(2)(3)(4)(5)(6) $ 1.56 Ì

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 35,502,006 $55.07 22,238,406

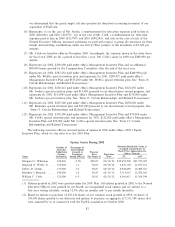

(1) Includes 1,623,993 shares of our common stock remaining available for future issuance under our

1998 Employee Stock Purchase Plan, as amended, or the ESPP, as of December 31, 2002. Our ESPP

contains an ""evergreen'' provision that automatically increases, on each January 1, the number of

securities available for issuance under the ESPP by the number of shares purchased under the ESPP

in the preceding calendar year. An aggregate amount of 176,007 shares was purchased under the

ESPP in 2002. None of our other plans has an ""evergreen'' provision.

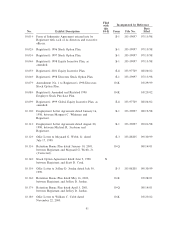

(2) Does not include 13,772 shares of our common stock, with a weighted average exercise price of $1.10

per share, to be issued upon exercise of outstanding options assumed by us under the Billpoint, Inc.

1999 Stock Option Plan, or the Billpoint Plan, in connection with our acquisition of Billpoint in 1999,

as we cannot make subsequent grants or awards of our equity securities under the Billpoint Plan. Prior

to our acquisition of Billpoint, the stockholders of Billpoint approved the Billpoint Plan. Our

stockholders, however, did not approve the Billpoint Plan in connection with our acquisition of

Billpoint.

(3) Does not include 95,363 shares of our common stock, with a weighted average exercise price of

$13.83 per share, to be issued upon exercise of outstanding options assumed by us under the

Half.com, Inc. 1999 Equity Compensation Plan, or the Half.com Plan, in connection with our

acquisition of Half.com in 2000, as we cannot make subsequent grants or awards of our equity

securities under the Half.com Plan. Prior to our acquisition of Half, the stockholders of Half approved

the Half.com Plan. Our stockholders, however, did not approve the Half.com Plan in connection with

our acquisition of Half.

(4) Does not include 59,159 shares of our common stock, with a weighted average exercise price of $0.43

per share, to be issued upon exercise of outstanding options assumed by us under the ConÑnity, Inc.

1999 Stock Plan, or the ConÑnity Plan, in connection with our acquisition of PayPal in October 2002,

as we cannot make subsequent grants or awards of our equity securities under the ConÑnity Plan. The

ConÑnity Plan was assumed by PayPal in connection with its merger with ConÑnity in 2000. Prior to

our acquisition of PayPal and PayPal's merger with ConÑnity, the stockholders of ConÑnity approved

the ConÑnity Plan. Our stockholders, however, did not approve the ConÑnity Plan in connection with

our acquisition of PayPal.

86