eBay 2002 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

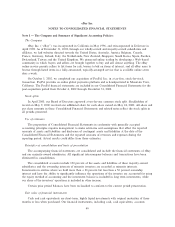

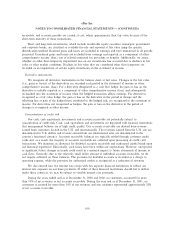

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

equity at risk to Ñnance its activities without additional subordinated Ñnancial support from other parties.

This interpretation applies immediately to variable interest entities created after January 31, 2003 and

applies in the Ñrst year or interim period beginning after June 15, 2003 to variable interest entities in

which an enterprise holds a variable interest that it acquired before February 1, 2003. We expect that the

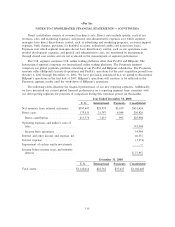

adoption of FIN 46 will require us to include our San Jose facilities lease arrangement and potentially

certain investments in our Consolidated Financial Statements eÅective July 1, 2003. In connection with

our San Jose facilities lease arrangement, our balance sheet following the July 1, 2003 adoption of FIN 46

will reÖect changes to record assets of $126.4 million, liabilities of $122.5 million and non-controlling

interests of $3.9 million. In addition, our post-adoption income statement will reÖect the reclassiÑcation of

rent expense payments from operating expenses to interest expense as well as the recognition of

depreciation expense, within operating expenses, for our use of the buildings. We estimate that the income

statement impact of consolidating our San Jose facilities lease will consist of a charge against earnings, net

of taxes, of $5.6 million upon the adoption of FIN 46 on July 1, 2003. This charge will reÖect the

accumulated depreciation charges that would have been recorded in previous periods had consolidation of

the San Jose facilities been required. Additionally, we have not decided whether we will keep the existing

Ñnancing arrangement or purchase the San Jose facilities. Whether or not we keep the existing Ñnancing

arrangement, we anticipate recording additional annual operating expenses of $1.7 million, net of taxes, for

the recognition of depreciation expense on the buildings. In the event we purchase the San Jose facilities,

we will also pay $126.4 million, eliminate Ñnancing payments and settle our two interest rate swaps we

used to establish a Ñxed rate of interest for $95 million of our Ñnancing arrangement. During the year

ended December 31, 2002, our Ñnancing payments related to the San Jose facilities totaled $7.9 million.

At December 31, 2002, settlement of our two interest rate swaps would have resulted in a loss of

$10.9 million.

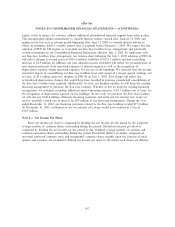

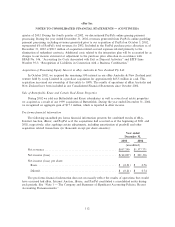

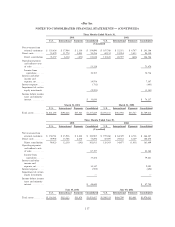

Note 2 Ì Net Income Per Share:

Basic net income per share is computed by dividing the net income for the period by the weighted

average number of common shares outstanding during the period. Diluted net income per share is

computed by dividing the net income for the period by the weighted average number of common and

common equivalent shares outstanding during the period. Potentially dilutive securities, composed of

unvested, restricted common stock and incremental common shares issuable upon the exercise of stock

options and warrants, are included in diluted net income per share to the extent such shares are dilutive.

107