eBay 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We receive tax deductions from the gains realized by employees on the exercise of certain non-

qualiÑed stock options for which the beneÑt is recognized as a component of stockholders' equity. We have

provided a full valuation allowance on the deferred tax assets relating to these stock option deductions due

to the uncertainties associated with our future stock price and the timing of employee stock option

exercises. To the extent that additional stock option deductions are not generated in future years, we will

have the ability, subject to carryforward limitations, to utilize up to $207.3 million of additional deferred

tax assets to reduce future income tax liabilities. When recognized, the tax beneÑt of tax deductions

related to stock options are accounted for as a credit to additional paid-in capital rather than a reduction

of the income tax provision.

Minority Interests in Consolidated Companies

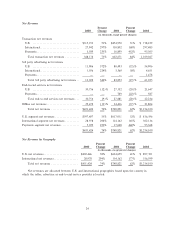

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Minority interests in consolidated

companies ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $3,062 145% $7,514 (131)% $ (2,296)

As a percentage of net revenue ÏÏÏÏÏÏÏÏÏÏÏ 1% 1% 0%

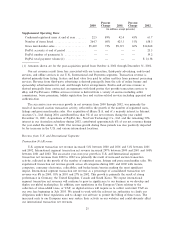

Minority interests in consolidated companies represents the minority investor's percentage share of

income or losses from subsidiaries in which we hold a majority ownership interest and consolidate the

subsidiaries' results in our Ñnancial statements.

Third parties held minority interests in Billpoint and eBay Japan in 2000; in Billpoint, Internet

Auction, and eBay Japan in 2001; in Billpoint for part of 2002 and Internet Auction for all of 2002. The

decrease in minority interests from 2001 to 2002 primarily resulted from Internet Auction generating net

income for the Ñrst time in 2002. Additionally, our January 2002 acquisition of the remaining 35%

minority interest in Billpoint previously held by Wells Fargo Bank also contributed to the decrease. We

expect that minority interests in consolidated companies will continue to Öuctuate in future periods. If

Internet Auction, our majority-owned South Korean subsidiary, continues to be proÑtable, the minority

interests adjustment on the statement of income will continue to decrease our net income by the minority

investor's share of Internet Auction's net income.

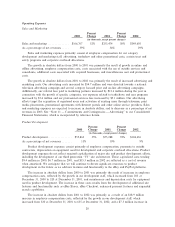

Impact of Foreign Currency Translation

The growth in our international operations has increased our exposure to foreign currency Öuctuations.

We have foreign currency denominated net revenues, costs and expenses. These income statement amounts

are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the

U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated

transactions results in increased net revenues, operating expenses and net income. Similarly, our net

revenues, operating expenses and net income will decrease when the U.S. dollar strengthens against foreign

currencies.

A signiÑcant portion of our international net revenues, operating expenses and net income are

denominated in Euros. During the year ended December 31, 2002, the U.S. dollar weakened against the

Euro and our weighted-average translation rate used to convert Euro denominated transactions into

U.S. dollar equivalents, decreased by approximately 6% compared to the weighted-average translation rate

for the year ended December 31, 2001. This weighted-average translation rate change for the Euro resulted

in increased net revenues of approximately $11.0 million and increased operating expenses of

approximately $5.0 million during the year ended December 31, 2002.

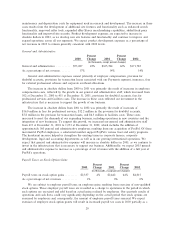

We expect our international operations will continue to grow in signiÑcance as we develop and deploy

our global marketplace. As a result, foreign currency Öuctuations in future periods could become more

signiÑcant or even have a negative impact on our net revenues and net income.

33