eBay 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

result of gains from the exercise of PayPal options assumed in the merger. In general, we expect payroll

taxes on employee stock option gains to increase during periods in which our stock price is high relative to

historic levels.

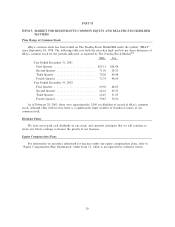

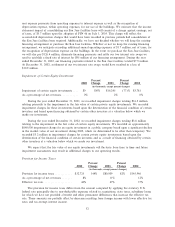

Amortization of Acquired Intangible Assets

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Amortization of acquired intangible assets $1,433 2,453% $36,591 (56)% $15,941

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏ 0% 5% 1%

From time to time we have purchased, and we expect to continue purchasing, assets or businesses to

accelerate category and geographic expansion, increase the features and functions available to our users

and maintain a leading role in online trading. These purchase transactions may result in the creation of

acquired intangible assets and lead to a corresponding increase in the amortization expense in future

periods.

Intangible assets are comprised of purchased customer lists, developed technologies, trade names, and

other intangible assets. Intangible assets, excluding goodwill, are being amortized using the straight-line

method over estimated useful lives ranging from two to seven years. We believe the straight-line method of

amortization best represents the distribution of economic value of the identiÑed intangible assets.

Goodwill represents the excess of the purchase price over the fair value of the net tangible and

identiÑable intangible assets acquired in a business combination. In accordance with SFAS No. 142,

goodwill is no longer subject to amortization. Rather, goodwill is subject to at least an annual assessment

for impairment, applying a fair-value based test.

Amortization of acquired intangible assets decreased during 2002, primarily from the elimination of

goodwill amortization as part of our adoption of SFAS No. 142, ""Goodwill and Other Intangible Assets''

on January 1, 2002.

IdentiÑable intangible assets arising from our October 3, 2002 acquisition of PayPal consist of

PayPal's customer list of $196.9 million, its trade name of $63.6 million and developed technologies of

$16.5 million. The acquired intangible assets of PayPal will be amortized over the following estimated

useful lives: customer list Ì seven years; trade name Ì seven years; and developed technologies Ì three

years. This allocation will result in annual amortization of approximately $28.1 million for the customer

list, $9.1 million for the trade name and $5.5 million for the existing technologies. We expect the full year

of amortization from PayPal's acquired intangible assets to result in an increase of amortization expense in

2003.

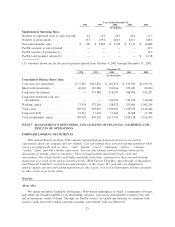

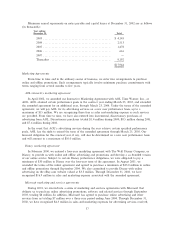

Merger-related Costs

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Merger related costs ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,550 (100)% $0 0% $0

As a percentage of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0% 0% 0%

Merger-related costs were primarily attributed to direct costs associated with mergers accounted for

under the pooling of interests method. These amounts consist primarily of professional services, contract

and facility termination expenses and various registration and Ñling fees. Direct costs associated with

mergers accounted for under the purchase method are capitalized in determining the purchase price.

We incurred direct merger-related transaction costs in 2000 related to the merger with Half.com. Due

to the elimination of the pooling of interests method of accounting, merger-related costs related to

acquisitions after July 2001 were capitalized as a component of purchase price.

30