eBay 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

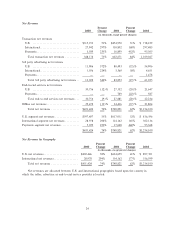

acquisition of PayPal. For the post-acquisition period from October 4, 2002 through December 31, 2002,

PayPal recorded transaction net revenue of $72.6 million. We expect to wind-down our Billpoint payment

operations during the Ñrst half of 2003.

Third-party Advertising and End-to-End Services Net Revenues

Payments segment revenues from third-party advertising and end-to-end services decreased as a

percentage of total Payments segment net revenues from 4% in 2001 to 2% in 2002 as transaction net

revenues grew faster than third-party advertising and end-to-end services net revenues. We continue to

view our business as primarily transaction driven, and we expect Payments segment third-party advertising

and end-to-end net revenues in future periods to continue to decrease as a percentage of total net revenues

and in absolute dollars.

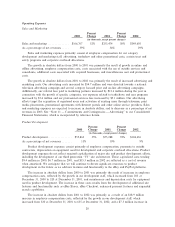

Cost of Net Revenues

Percent Percent

2000 Change 2001 Change 2002

(in thousands, except percent changes)

Cost of net revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $95,453 41% $134,816 59% $213,876

As a percentage of net revenues ÏÏÏÏÏÏ 22% 18% 18%

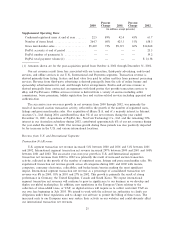

Cost of net revenues consists primarily of costs associated with customer support, site operations, and

payment processing. SigniÑcant cost components include employee compensation and facilities costs for

customer support, site operations, Internet connectivity charges, depreciation of site equipment, payment

processing fees, amortization of required capitalization of major site and product development costs,

including the amortization of capitalized costs related to the development of our third generation ""V3'' site

architecture, costs to provide end-to-end services and promotions and corporate overhead allocations.

Cost of net revenues increased in absolute dollars but decreased as a percentage of net revenues from

2000 to 2001. This increase in absolute dollars was due almost entirely to our online business as we

continued to develop and expand our customer support and site operations infrastructure. The increases

were primarily the result of personnel costs, depreciation of the equipment required for site operations,

software licensing fees, Internet connectivity charges and the increased costs associated with acquired

businesses. The decrease in cost of net revenues as a percentage of net revenue resulted from cost

management initiatives and lower technology costs in site operations and increases in higher gross margin

businesses such as autos, third-party advertising and end-to-end services and promotions. The combined

eÅect of these activities resulted in our cost of net revenues per listing decreasing from $0.36 in 2000 to

$0.32 in 2001.

Cost of net revenues increased in absolute dollars but remained constant as a percentage of net

revenues from 2001 to 2002. This increase in absolute dollars was due to increased payment processing

costs resulting from our acquisition of PayPal and continued development and expansion of our customer

support and site operations infrastructure. The increase in payment processing costs totaled $50.4 million

and consists of bank charges, credit card interchange fees, and other processing charges. The increase in

customer support and site operations costs were primarily the result of increased depreciation of site

operations software and equipment of $10.9 million and personnel costs of $7.7 million. Cost of net

revenues stayed constant as a percentage of net revenue from 2001 to 2002 and reÖects cost eÇciencies in

both customer support and site operations oÅset by the addition of PayPal's lower margin payments

processing business. The combined eÅect of these activities resulted in our cost of net revenues per listing

increasing from $0.32 in 2001 to $0.34 in 2002. We expect the cost of net revenues to increase in absolute

dollars and increase as a percentage of net revenues in 2003 as a result of the addition of a full year of

PayPal's lower margin payments processing business.

27