eBay 2002 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2002 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

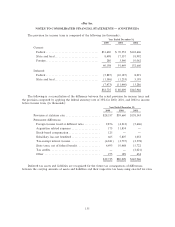

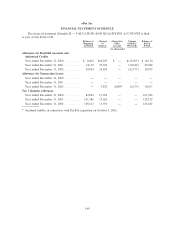

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (CONTINUED)

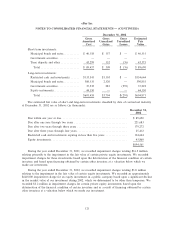

Notes receivable from eBay executive oÇcers

At December 31, 2001 and 2002, we held notes receivable from certain executive oÇcers totaling

$4.3 million and $3.5 million, respectively. One note is a non-interest bearing note issued in connection

with the relocation of one executive oÇcer to San Jose, California, while the remaining notes bear interest

at rates of 4.94%, 6.37%, and 6.40% per year. Each note is collateralized by Deeds of Trust, which we

hold. The outstanding principal and interest are due and payable by 2005.

Note 13 Ì Preferred Stock:

We are authorized, subject to limitations prescribed by Delaware law, to issue Preferred Stock in one

or more series; to establish the number of shares included within each series; to Ñx the rights, preferences

and privileges of the shares of each wholly unissued series and any related qualiÑcations, limitations or

restrictions; and to increase or decrease the number of shares of any series (but not below the number of

shares of a series then outstanding) without any further vote or action by the stockholders. At

December 31, 2001 and 2002, there were 10 million shares of Preferred Stock authorized for issuance, and

no shares issued or outstanding.

Note 14 Ì Common Stock:

Our CertiÑcate of Incorporation, as amended, authorizes us to issue 900 million shares of common

stock. A portion of the shares outstanding are subject to repurchase over a four-year period from the

earlier of the issuance date or employee hire date, as applicable. At December 31, 2001, there were

772,000 shares subject to repurchase rights at an average price of $0.36. At December 31, 2002, there

were 184,000 shares subject to repurchase at an average price of $0.89.

At December 31, 2002, we had reserved 22.2 million shares of common stock available for future

issuance under our stock option plans and approximately 1.6 million shares of common stock available for

future issuance under the employee stock purchase plan.

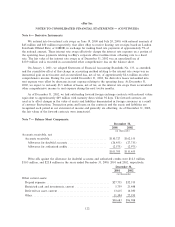

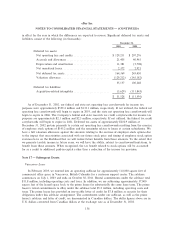

In connection with certain stock option grants, we recorded unearned stock-based compensation

totaling $187,000 during the year ended December 31, 2000, $4.1 million in 2001, and $9.9 million in

2002. The unearned compensation for 2000 is related to the acquisition of Half.com and was amortized

fully over the vesting period in 2000. The unearned compensation for 2001 is related to the acquisition of

Internet Auction and is being amortized over the 3-year vesting period of the options, which ends in 2002.

The unearned compensation for 2002 is related to the acquisition of PayPal and is being amortized over

the 3-year vesting period of the options, which ends in 2005. Amortization expense totaled approximately

$7.1 million during the year ended December 31, 2000, $3.1 million in 2001, $6.0 million in and 2002. The

unearned stock compensation balance at December 31, 2002 was $5.3 million and will be amortized over

the remaining vesting period through 2005.

Note 15 Ì Employee BeneÑt Plans:

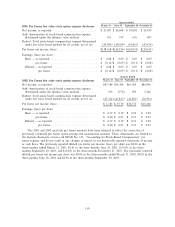

Employee Stock Purchase Plan

We have an employee stock purchase plan for all eligible employees. Under the plan, shares of our

common stock may be purchased over an oÅering period with a maximum duration of two years at 85% of

the lower of the fair market value on the Ñrst day of the applicable oÅering period or on the last day of

the six-month purchase period. Employees may purchase shares having a value not exceeding 10% of their

gross compensation during an oÅering period. During the years ended December 31, 2000, 2001 and 2002,

employees purchased 438,000, 124,000 and 176,000 shares at average prices of $8.43, $43.72 and $45.25

per share, respectively. At December 31, 2002, approximately 1.6 million shares were reserved for future

issuance. On each January 1, the aggregate number of shares reserved for issuance under the employee

131