Zynga 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

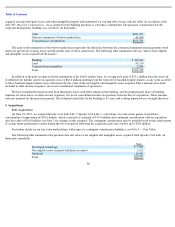

terms of certain of our acquisition agreements. Other liabilities include various expenses that we accrue for transaction taxes, compensation

liabilities, restructuring charges and accrued accounts payable.

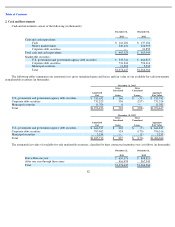

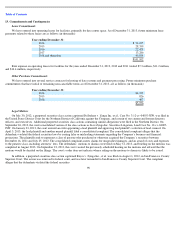

10. Restructuring

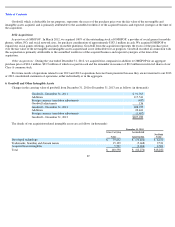

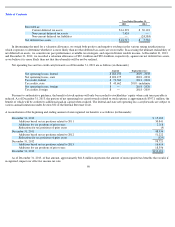

2013 Restructuring Plans

During 2013, we reduced our work force by approximately 550 employees and closed or exited certain office and data-center facilities as

part of an overall plan to better align our cost structure against market opportunities. As a result, we recorded restructuring charges of $42.9

million in the year ended December 31, 2013 which is included in operating expenses in our consolidated statement of operations. This

restructuring charge was composed of $25.6 million of employee severance, $15.7 million related to non-cancelable contracts and $1.6 million

related to other non-cash charges, and does not include the impact of $16.6 million of net stock-based expense reversals associated with the net

effect of forfeitures from employee terminations and the acceleration of unvested stock awards which were recorded in stock-based expense.

The remaining liability related to our 2013 restructuring plans as of December 31, 2013 was $13.5 million. This remaining liability

substantially relates to cancelled contracts and exited facilities that have lease terms which expire over the next four years.

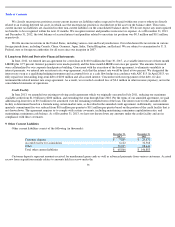

2012 Restructuring Plan

During the fourth quarter of 2012, we implemented certain cost reduction initiatives, including a workforce reduction of 155 employees

and the consolidation of certain real estate facilities which resulted in our exit from certain facilities for which we had non-cancellable operating

leases.

For the year ended December 31, 2012, we recorded $7.9 million in restructuring charges in operating expenses within our consolidated

statement of operations, which includes employee severance costs of $7.0 million and other expenses of $0.9 million. This restructuring charge

did not include the impact of $6.9 million of 2012 stock-based expense reversals associated with employee terminations as a result of our

restructuring, which were recognized in operating expenses within our consolidated statements of operations.

For the year ended December 31, 2013, we recorded $1.7 million in restructuring charges related to our 2012 restructuring plan. This

restructuring charge did not include the impact of $0.2 million of 2012 stock-

based expense reversals associated with employee terminations as a

result of our restructuring, which were recognized in operating expenses within our consolidated statement of operations. As of December 31,

2013, there were no future payments remaining related to the 2012 restructuring plan.

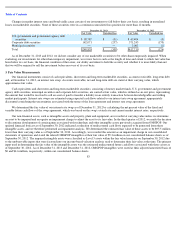

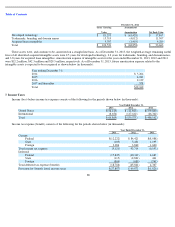

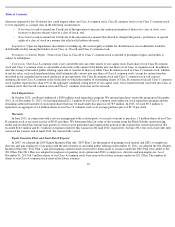

11. Stockholders’ Equity

Common Stock

Our three classes of common stock are Class A common stock, Class B common stock and Class C common stock. The following are the

rights and privileges of our classes of common stock:

Dividends . The holders of outstanding shares of our Class A, Class B and Class C common stock are entitled to receive dividends out of

funds legally available at the times and in the amounts that our Board of Directors (the “Board”) may determine.

Voting Rights . Holders of our Class A common stock are entitled to one vote per share, holders of our Class B common stock are entitled

to seven votes per share and holders of our Class C common stock are entitled to 70 votes per share. In general, holders of our Class A common

stock, Class B common stock and Class C common stock will vote together as a single class on all matters submitted to a vote of stockholders,

unless

92