Zynga 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

these acquisition and retention-related programs may become either less effective or more costly, negatively impacting our operating results. We

may incur increased player acquisition costs as our ability to cross-promote traffic to games that are offered on platforms other than Facebook,

for example, games offered on Zynga.com, as well as our RMG offerings with bwin.party, are limited by Facebook’s standard terms of service,

subject to certain exceptions.

New market development. We are investing in new distribution channels, mobile platforms and international markets to expand our reach

and grow our business. For example, we have continued to hire additional employees and acquire companies with experience developing mobile

applications. Our ability to be successful will depend on our ability to develop a successful mobile network, obtain new players and retain

existing players on new and existing social networks and attract advertisers.

We entered into an agreement with bwin.party to offer RMG products in the United Kingdom and in the second quarter of 2013, we

launched our first RMG offerings, ZyngaPlusPoker and ZyngaPlusCasino , in the United Kingdom. However, we are evaluating our RMG

products in the United Kingdom to determine whether or not they are on strategy and aligned with our near term market opportunities and

priorities. In July 2013, we decided to withdraw our application from the Nevada Gaming Control Board and made the focused choice not to

pursue a license for real money gaming in other U.S. jurisdictions at this time in order to focus our resources and priorities against the growing

market in free, social gaming, including social casino offerings.

As we expand into new markets and distribution channels, we expect to incur headcount, marketing and other operating costs in advance of

the associated bookings and revenue. Our financial performance will be impacted by our investment in these initiatives and their success.

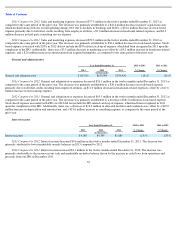

Stock-based expense. Prior to our initial public offering (the “IPO”), we granted restricted stock units, (“ZSUs”), to our employees that

generally vested upon the satisfaction of both a service-period condition of up to four years and a liquidity event condition, the latter of which

was satisfied upon our initial public offering. Because the liquidity event condition was not met until our IPO, prior to the fourth quarter of 2011,

we had not recorded any expense related to our ZSUs. In the twelve months ended December 31, 2013, we recognized $54.7 million, of stock-

based expense related to ZSUs compared to $204.7 million in the twelve months ended December 31, 2012 and $510.0 million in the twelve

months ended December 31, 2011.

Hiring and retaining key personnel. Our ability to compete and grow depends in large part on the efforts and talents of our employees. In

2013, in addition to experiencing employee attrition, we also implemented, and continue to implement, certain cost reduction initiatives to better

align our operating expenses with our revenue, including reducing our headcount and consolidating certain facilities. These cost reduction

initiatives could negatively impact our ability to attract, hire and retain key employees which is critical to our ability to grow our business and

execute on our business strategy.

49