Zynga 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

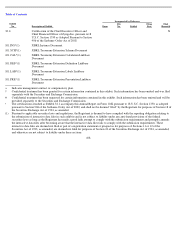

Table of Contents

laws by issuing false or misleading statements in connection with an April 2012 secondary offering of Class A common stock. The plaintiff

seeks to represent a class of persons who acquired the Company’s common stock pursuant or traceable to the secondary offering. On June 10,

2013, the defendants filed a demurrer and motion to stay the action. On August 26, 2013, the court issued orders overruling the demurrer and

granting the motion to stay all deadlines in the action pending a ruling on the motion to dismiss in the federal securities class action described

above.

On April 4, 2013, a purported class action captioned Lee v. Pincus, et al. was filed in the Court of Chancery of the State of Delaware

against the Company, and certain of our current and former directors, officers, and executives. The complaint alleges that the defendants

breached fiduciary duties in connection with the release of certain lock-up agreements entered into in connection with the Company’s initial

public offering. The plaintiff seeks to represent a class of certain of the Company’s shareholders who were subject to the lock-

up agreements and

who were not permitted to sell shares in an April 2012 secondary offering. The defendants removed the case to the United States District Court

for the District of Delaware on May 10, 2013. On December 23, 2013, the district court granted the plaintiff’

s motion to remand the action to the

Court of Chancery. On January 8, 2014, the Chancery Court entered a scheduling order. On January 17, 2014, the plaintiff filed an amended

complaint. The Company’s deadline to respond to the amended complaint is March 6, 2014.

The Company believes it has meritorious defenses in the above securities class actions and will vigorously defend these actions.

Since August 3, 2012, eight stockholder derivative lawsuits have been filed in State or Federal courts in California and Delaware

purportedly on behalf of the Company against certain current and former directors and executive officers of the Company. The derivative

plaintiffs allege that the defendants breached their fiduciary duties and violated California Corporations Code section 25402 in connection with

our initial public offering in December 2011, secondary offering in April 2012, and allegedly made false or misleading statements regarding the

Company’s business and financial projections. Beginning on August 3, 2012, three of the actions were filed in San Francisco County Superior

Court. On October 2, 2012, the court consolidated those three actions as In re Zynga Shareholder Derivative Litigation, Lead Case CGC-12-

522934. On March 14, 2013, the plaintiffs filed a First Amended Complaint. On March 21, 2013, the court endorsed a stipulation among the

parties staying the action pending the ruling on the motion to dismiss in the federal securities class action described above. Beginning on

August 16, 2012, four stockholder derivative actions were filed in the United States District Court for the Northern District of California. On

December 3, 2012, the court consolidated these four actions as In re Zynga Inc. Derivative Litigation, Lead Case No. 12-CV-4327-JSW. On

March 11, 2013, the court endorsed a stipulation among the parties staying the action pending the ruling on the motion to dismiss in the federal

securities class action described above. A derivative action was also filed in the United States District Court for the District of Delaware. The

plaintiff in the District of Delaware action voluntarily dismissed the action on November 19, 2012. The derivative actions include claims for,

among other things, unspecified damages in favor of the Company, certain corporate actions to purportedly improve the Company’s corporate

governance, and an award of costs and expenses to the derivative plaintiffs, including attorneys’ fees. We believe that the plaintiffs in the

derivative actions lack standing to pursue litigation on behalf of Zynga.

To date, there has been no discovery or other substantive proceedings in the actions described above. Accordingly, we are not in a position

to assess whether any loss or adverse effect on our financial condition is probable or remote or to estimate the range of potential loss, if any.

On February 10, 2012, an action entitled Personalized Media Communications, LLC v. Zynga Inc., Case No. 2:12-cv-68 was filed against

the Company in the United States District Court for the Eastern District of Texas. The plaintiff alleged infringement of four patents by 39 games.

On January 25, 2013, the court denied the Company’s motion to transfer the action to the Northern District of California. During the course of

the action, the plaintiff narrowed the case for trial to two patents. Plaintiff’s damages expert opined that, if the Company were found to infringe

and the patents-in-suit were found to be valid (both of which the Company disputed), the

99