Zynga 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

refunded their accrued contributions that have not yet been used to purchase shares. Participation ends automatically upon termination of

employment with us.

As of December 31, 2013, there were $2.7 million employee contributions withheld by the Company. In 2013, the Company recognized

$4.3 million of stock-based expense related to 2011 ESPP.

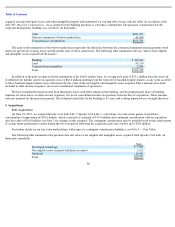

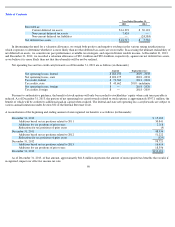

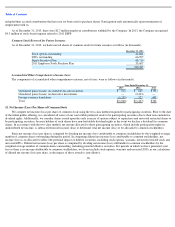

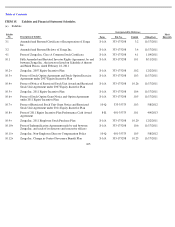

Common Stock Reserved for Future Issuance

As of December 31, 2013, we had reserved shares of common stock for future issuance as follows (in thousands):

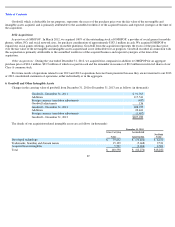

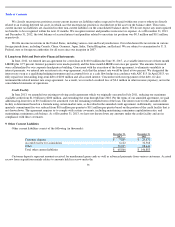

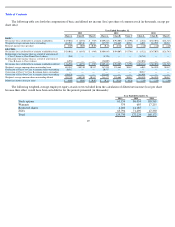

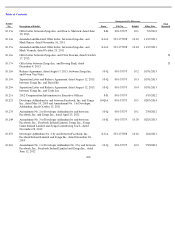

Accumulated Other Comprehensive Income (loss)

The components of accumulated other comprehensive income, net of taxes, were as follows (in thousands):

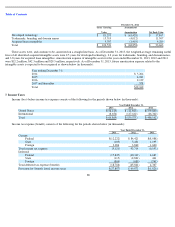

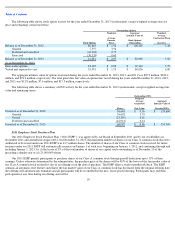

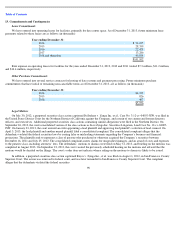

12. Net Income (Loss) Per Share of Common Stock

We compute net income (loss) per share of common stock using the two-

class method required for participating securities. Prior to the date

of the initial public offering, we considered all series of our convertible preferred stock to be participating securities due to their non-cumulative

dividend rights. Additionally, we consider shares issued upon the early exercise of options subject to repurchase and unvested restricted shares to

be participating securities, because holders of such shares have non-forfeitable dividend rights in the event we declare a dividend for common

shares. In accordance with the two-class method, net income allocated to these participating securities, which include participation rights in

undistributed net income, is subtracted from net income (loss) to determine total net income (loss) to be allocated to common stockholders.

Basic net income (loss) per share is computed by dividing net income (loss) attributable to common stockholders by the weighted-average

number of common shares outstanding during the period. In computing diluted net income (loss) attributable to common stockholders, net

income (loss) is re-allocated to reflect the potential impact of dilutive securities, including stock options, warrants, unvested restricted stock and

unvested ZSUs. Diluted net income (loss) per share is computed by dividing net income (loss) attributable to common stockholders by the

weighted-average number of common shares outstanding, including potential dilutive securities. For periods in which we have generated a net

loss or there is no income attributable to common stockholders, we do not include stock options, warrants and unvested ZSUs in our calculation

of diluted net income (loss) per share, as the impact of these awards is anti-dilutive.

96

December 31, 2013

Stock options outstanding

41,081

ZSUs outstanding

66,997

Equity Incentive Plan

68,710

2011 Employee Stock Purchase Plan

33,697

210,485

Year Ended December 31,

2013

2012

2011

Unrealized gains (losses) on available-for-sale securities

$

213

$

649

$

(91

)

Unrealized gains (losses) on derivative investments

—

(

2,423

)

—

Foreign currency translation

(1,259

)

327

453

Total

$

(1,046

)

$

(1,447

)

$

362