Zynga 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

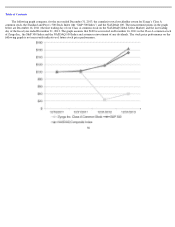

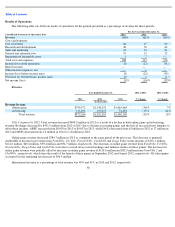

Average monthly unique payer bookings decreased in each quarter during 2013 due to the decline in bookings and users in our existing

games that were not offset by growth from new game launches. Monthly unique payer bookings per MUP increased to $28 in the fourth quarter

of 2013 due to MUP decreasing faster than unique payer bookings for the period. Average MUPs decreased from 2.5 million in the first quarter

of 2013 to 1.3 million in the fourth quarter of 2013. In periods with more mobile game launches we have seen higher MUPs without a significant

increase in average monthly unique payer bookings due to the inclusion of payers who make one-time download payments for the ad-free

version of our game within our reported MUPs.

Although we monitor our unique payer metrics, we focus on monetization, including through in-game advertising, of all of our players and

not just our payers. Accordingly, we strive to enhance content and our players’ game experience to increase our bookings and ABPU, which is a

measure of overall monetization across all of our players through the sale of virtual goods and advertising.

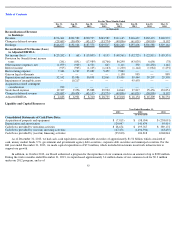

Future growth in audience and engagement will depend on our ability to retain current players, attract new players, launch new games and

expand into new markets and distribution platforms, and the success of our network. Our operating metrics may not correlate directly to

quarterly bookings or revenue trends in the short term.

Recent Developments

In June of 2013, Owen Van Natta resigned from his position as a director of the Company.

During 2013, three members of our executive management team, Reginald Davis, David Ko and Cadir Lee, left the Company.

47

•

Game Launches.

We launched several new games in 2013, including Hidden Shadows , Ninja Kingdom and Hit it Rich on web

platforms and

Stampede Run, What

’

s the Phrase

,

Draw Something 2

and

CastleVille Legends

on mobile platforms.

•

Operating Results.

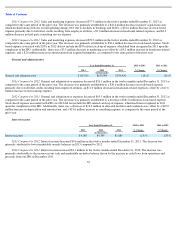

Our operating results generally declined in 2013 as compared to 2012. Total bookings decreased by 38% and

adjusted EBITDA decreased by 78% compared to 2012. These results primarily reflect weakness and declines in our existing games

and the lack of successful launches of new hit games. We have reduced our total costs and expenses by $525.3 million in 2013,

reflecting our focus on driving efficiencies during this period where players are using mobile devices more frequently.

•

Mobile Growth.

In 2013, we saw 9% and 11% year-over-year growth in bookings and revenue, respectively, on mobile platforms as

our players continued to play our games on their phones and tablets.

•

RMG.

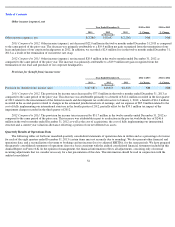

In April 2013, we launched our first real money gaming (RMG) offerings, ZyngaPlusPoker and ZyngaPlusCasino, in the

United Kingdom through our agreement with bwin.party digital entertainment plc (“bwin.party”).

Although we are still exploring our

options with respect to real money gaming, including with our partner, bwin.party in the United Kingdom, in July 2013, we decided

to withdraw our application from the Nevada Gaming Control Board and made the focused choice not to pursue a license for real

money gaming in other U.S. jurisdictions at this time in order to focus our resources and priorities against the growing market in free,

social gaming, including social casino offerings.

•

Changes in Executive Team and Board of Directors

. In July 2013, Don A. Mattrick replaced Mark Pincus as our Chief Executive

Officer and was appointed as a director. Mr. Pincus continues to serve as Chairman of the Board and Chief Product Officer of the

Company. Additionally, Mr. Pincus and Mr. Mattrick were appointed to a newly formed Executive Committee of the Board of

Directors, (the “Board”), the Executive Committee, which serves as an administrative committee of the Board to facilitate approval

of certain corporate actions in the intervals between full meetings of the Board. Subject to certain limitations set forth in its charter,

the Executive Committee will serve to manage our operations and affairs between Board meetings, and will report to the full Board.