Zynga 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Liquidity and Capital Resources

As of December 31, 2013, we had cash, cash equivalents and marketable securities of approximately $1.54 billion, which consisted of

cash, money market funds, U.S. government and government agency debt securities, corporate debt securities and municipal securities. For the

full year ended December 31, 2013, we made capital expenditures of $7.8 million, which included investments in network infrastructure to

support our growth.

In addition, in October 2012, our Board authorized a program for the repurchase of our common stock in an amount of up to $200 million.

During the twelve months ended December 31, 2013, we repurchased approximately 3.4 million shares of our common stock for $9.3 million

under our 2012 program, and as of

57

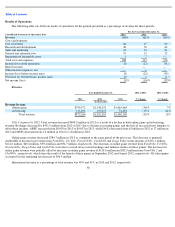

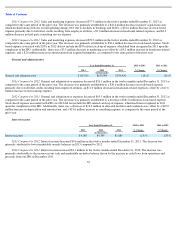

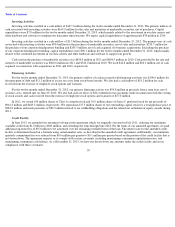

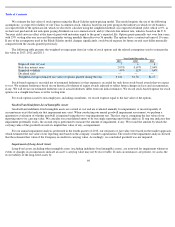

For the Three Months Ended

Dec 31,

2013

Sep 30,

2013

Jun 30,

2013

Mar 31,

2013

Dec 31,

2012

Sep 30,

2012

Jun 30,

2012

Mar 31,

2012

(in thousands)

Reconciliation of Revenue

to Bookings:

Revenue

$

176,362

$

202,580

$

230,735

$

263,589

$

311,165

$

316,637

$

332,493

$

320,972

Change in deferred revenue

(29,685

)

(50,474

)

(43,157

)

(33,774

)

(49,896

)

(61,031

)

(30,905

)

8,192

Bookings

$

146,677

$

152,106

$

187,578

$

229,815

$

261,269

$

255,606

$

301,588

$

329,164

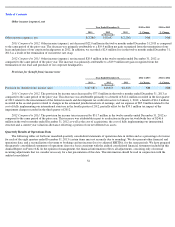

Reconciliation of Net Income (Loss)

to Adjusted EBITDA:

Net income (loss)

$

(25,242

)

$

(68

)

$

(15,805

)

$

4,133

$

(48,561

)

$

(52,725

)

$

(22,811

)

$

(85,351

)

Provision for (benefit from) income

taxes

(241

)

(891

)

(17,989

)

(8,766

)

86,290

(43,035

)

6,696

(78

)

Other income (expense), net

(1,079

)

(929

)

4,531

863

1,111

350

(21,250

)

1,142

Interest income

(915

)

(965

)

(1,105

)

(1,163

)

(1,230

)

(1,144

)

(1,084

)

(1,291

)

Restructuring expense

7,366

6,769

25,089

5,459

7,862

—

—

—

Gain on legal settlements

—

—

—

—

1,150

985

—

889

Depreciation and amortization

32,142

33,986

30,858

32,061

33,430

39,444

39,207

29,398

Impairment of intangible assets

—

10,217

—

—

—

95,493

—

—

Acquisition-related contingent

consideration

930

—

—

—

—

—

—

—

Stock

-

based expense

19,327

9,256

25,888

29,922

14,862

37,817

95,456

133,851

Change in deferred revenue

(29,685

)

(50,474

)

(43,157

)

(33,774

)

(49,896

)

(61,031

)

(30,905

)

8,192

Adjusted EBITDA

$

2,603

$

6,901

$

8,310

$

28,735

$

45,018

$

16,154

$

65,309

$

86,752

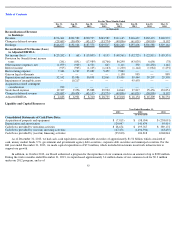

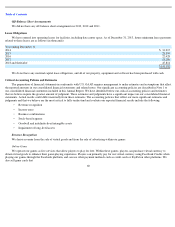

Year Ended December 31,

2013

2012

2011

(in thousands)

Consolidated Statements of Cash Flows Data:

Acquisition of property and equipment

$

(7,813

)

$

(98,054

)

$

(238,091

)

Depreciation and amortization

129,047

141,479

95,414

Cash flows provided by operating activities

$

28,674

$

195,767

$

389,172

Cash flows provided by (used in) investing activities

147,476

(1,496,934

)

(63,455

)

Cash flows provided by (used in) financing activities

(95,818

)

104,818

1,068,844