Zynga 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Goodwill, which is deductible for tax purposes, represents the excess of the purchase price over the fair value of the net tangible and

intangible assets acquired, and is primarily attributable to the assembled workforce of the acquired business and expected synergies at the time of

the acquisition.

2012 Acquisitions

Acquisition of OMGPOP . In March 2012, we acquired 100% of the outstanding stock of OMGPOP, a provider of social games for mobile

phones, tablets, PCs and social network sites, for purchase consideration of approximately $183.1 million in cash. We acquired OMGPOP to

expand our social games offerings, particularly on mobile platforms. Goodwill from the acquisition represents the excess of the purchase price

over the fair value of the net tangible and intangible assets acquired and is not deductible for tax purposes. Goodwill recorded in connection with

this acquisition is primarily attributable to the assembled workforce of the acquired business and expected synergies at the time of the

acquisition.

Other Acquisitions . During the year ended December 31, 2012, we acquired four companies in addition to OMGPOP for an aggregate

purchase price of $24.1 million, $23.9 million of which was paid in cash and the remainder in issuance of $0.2 million in restricted shares of our

Class A common stock.

Pro forma results of operations related to our 2013 and 2012 acquisitions have not been presented because they are not material to our 2013

or 2012 consolidated statements of operations, either individually or in the aggregate.

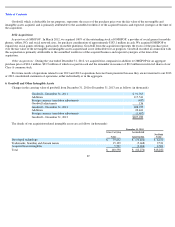

6. Goodwill and Other Intangible Assets

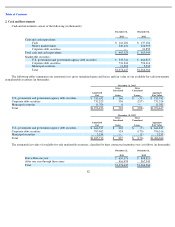

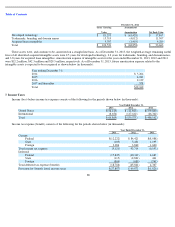

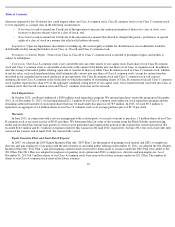

Changes in the carrying value of goodwill from December 31, 2011to December 31, 2013 are as follows (in thousands):

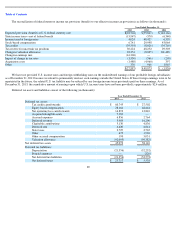

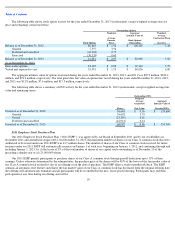

The details of our acquisition-related intangible assets are as follows (in thousands):

87

Goodwill

–

December 31, 2011

$

91,765

Additions

117,541

Foreign currency translation adjustments

(487

)

Goodwill adjustments

136

Goodwill

–

December 31, 2012

208,955

Additions

20,441

Foreign currency translation adjustments

(1,407

)

Goodwill

–

December 31, 2013

$

227,989

December 31, 2013

Gross Carrying

Value

Accumulated

Amortization

Net Book

Value

Developed technology

$

79,652

$

(73,402

)

$

6,250

Trademarks, branding and domain names

15,199

(5,668

)

9,531

Acquired lease intangibles

5,707

(3,206

)

2,501

Total

$

100,558

$

(82,276

)

$

18,282